Here’s what happened in crypto today

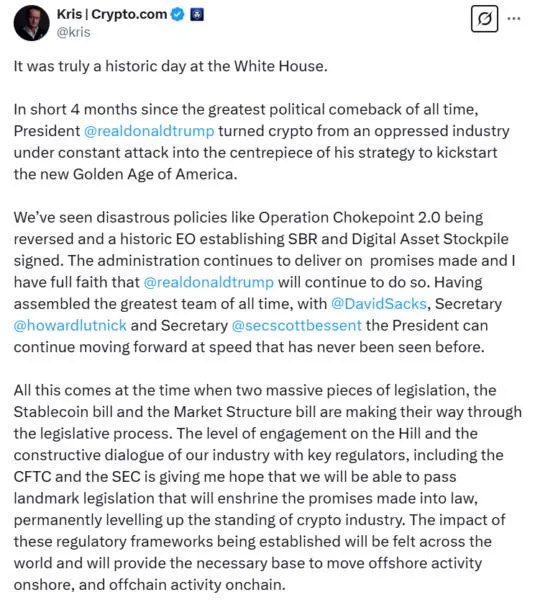

Today in crypto, the White House Crypto Summit marked a “truly historic day at the White House,” according to Crypto.com CEO Kris Marszalek, the US Office of the Comptroller of the Currency (OCC) has reduced “the burden” on how US banks can engage with crypto-related activities, and the White House crypto czar David Sacks emphasized Bitcoin’s scarcity and its potential long-term benefits for the US.Trump turned crypto from “oppressed industry” to “centerpiece” of US strategyUS President Donald Trump has placed cryptocurrency at the center of his economic strategy, marking a major policy shift for the US blockchain industry, according to Crypto.com CEO Kris Marszalek.Trump hosted a White House Crypto Summit on March 7, signaling that he intends to make crypto policy a national priority and make the US a global hub for blockchain innovation. The summit marked a “truly historic day at the White House,” Marszalek said in a March 8 X post.Marszalek credited Trump with reversing policies like Operation Chokepoint 2.0, which allegedly led to crypto and tech firms being denied banking services under the Biden administration.The difficulties of finding banking partners may indeed be a thing of the past for crypto firms after the US Office of the Comptroller of the Currency (OCC) eased its stance on how banks can engage with crypto just hours after Trump vowed to end the prolonged crackdown restricting crypto firms’ access to banking services.OCC lays out crypto banking after Trump vows to end Operation Chokepoint 2.0The US Office of the Comptroller of the Currency (OCC) has eased its stance on how US banks can engage with crypto just hours after US President Donald Trump vowed to end the prolonged crackdown restricting crypto firms’ access to banking services.“Crypto-asset custody, certain stablecoin activities, and participation in independent node verification networks such as distributed ledger are permissible for national banks and federal savings associations,” the OCC said in a March 7 statement.The OCC confirmed in a document titled Interpretive Letter 1183 that OCC-supervised financial institutions no longer need “supervisory nonobjection” to engage with crypto-related activities.“Today’s action will reduce the burden on banks to engage in crypto-related activities and ensure that these bank activities are treated consistently by the OCC,” Acting Comptroller of the Currency Rodney E. Hood said.The agency said it made the decision because OCC staff now have a better grasp of crypto and want to roll back its earlier stringent rules to “encourage responsible innovation and enhance transparency.”“We’ve decided Bitcoin is scarce, it’s valuable” for US strategic reserve — David SacksWhite House crypto czar David Sacks has further elaborated on the US government’s decision to treat Bitcoin as a special reserve asset, calling it a “scarce” digital resource that could benefit the country over the long term. In a March 7 interview with Bloomberg Technology, Sacks said, “We’ve decided that Bitcoin is scarce, it’s valuable, and that it’s strategic for the United States to hold on to this as a long-term reserve asset.”Sacks was referring specifically to the roughly 200,000 Bitcoin (BTC) currently in the US government’s possession. However, he acknowledged that the exact number of BTC held by the government is unknown because there’s never been a comprehensive audit.“We’re going to do a full government-wide audit to find out what digital assets we actually have so they can be safeguarded and moved into a strategy that maximizes their long-term value,” he said.President Donald Trump’s March 6 executive order calling for a strategic Bitcoin reserve and digital asset stockpile directed federal agencies to conduct a full audit of their cryptocurrency holdings.