Here’s what happened in crypto today

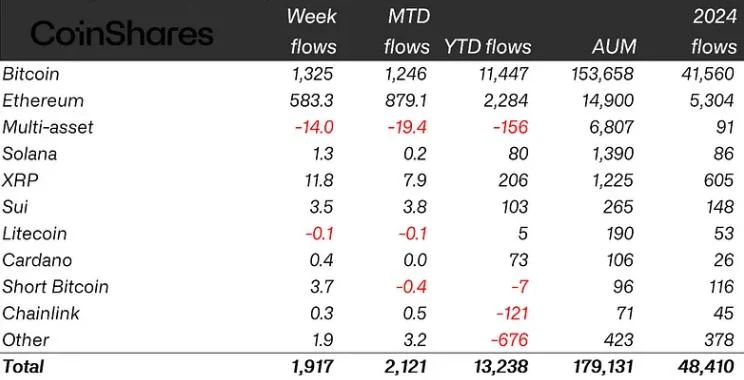

Today in crypto, Coinbase and Gemini are pursuing licenses to operate in Europe. Crypto investment funds recorded fresh inflows last week amid a broader market rebound. Meanwhile, Strategy's Michael Saylor is reportedly advising Pakistan on its national crypto strategy.Gemini, Coinbase expected to secure EU licenses under MiCA — ReportCrypto exchanges Gemini and Coinbase are reportedly set to secure licenses to operate in the European Union, marking a significant step in their expansion under the newly implemented Markets in Crypto-Assets (MiCA) regulations.Gemini is on track to receive approval from Malta, while Coinbase is expected to obtain its license through Luxembourg, Reuters reported Monday, citing unnamed sources familiar with the matter.A Coinbase spokesperson declined to comment on the specific application but told Reuters that Luxembourg is a “well-respected global financial center.”Gemini and Coinbase would join other major exchanges moving into the EU under the MiCA framework. As previously reported by Cointelegraph, Bybit recently gained regulatory approval to operate in the region via Austria.In January, Binance updated its deposit and withdrawal procedures in Poland to comply with the MiCA framework. Regulations under the MiCA framework took effect in June 2024, with full implementation following in December after the European Securities and Markets Authority (ESMA) issued final guidance for EU member states.Crypto funds notch $1.9 billion of inflows as Bitcoin reboundsCryptocurrency investment products continued their multi-week inflow streak as Bitcoin (BTC) traded close to new highs and Ether briefly surged past $2,800 for the first time since February.Global crypto exchange-traded products (ETPs) recorded $1.9 billion of inflows in the trading week ended Friday, moving a nine-week streak of inflows to $12.9 billion, CoinShares reported on Monday.With the new inflows, crypto ETPs set a historic record of year-to-date (YTD) inflows of $13.2 billion, wrote CoinShares’ head of research, James Butterfill.Total assets under management (AUM) in crypto ETPs edged up to $179 billion from last week’s $175.9 billion.After two weeks of minor outflows, Bitcoin investment products recovered to see significant gains, topping the chart last week with $1.3 billion of inflows. Short-Bitcoin products also recorded modest inflows of $3.7 million, though their AUM remained low at $96 million.Ether (ETH) ETPs ranked second in inflows, maintaining their positive trend with a further $583 million in inflows last week. According to CoinShares’ Butterfill, the inflows marked ETH product’s largest gains since February, including their strongest single-day inflows.Following a three-week run of outflows, XRP (XRP) investment products saw $11.8 million in inflows last week, while Sui (SUI) products saw a further $3.5 million in inflows.Strategy’s Michael Saylor to help Pakistan with crypto pivotPakistan has secured another big name to support its crypto pivot after Strategy executive chair Michael Saylor met with the country’s Ministry of Finance to laud its crypto efforts.Saylor met with Pakistan Finance Minister Muhammad Aurangzeb and the country’s State minister on blockchain and crypto, Bilal Bin Saqib, on Sunday and discussed how Bitcoin can function in a state reserve and the country’s planned crypto policies, while Saylor welcomed coming on an as adviser, local media outlet Dawn reported, citing a press release.Bitcoin pioneer Michael Saylor met with Finance Minister Muhammad Aurangzeb & Minister of State for Crypto Bilal Bin Saqib to discuss using #Bitcoin for national reserves & digital transformation.Saylor praised Pakistan’s bold vision:“Emerging markets like Pakistan have a… pic.twitter.com/wMrKWrX9WnIn a video posted to X on Sunday by a Finance Ministry official, Saylor told the pair that “Pakistan has many brilliant people and a lot of people do business with you” and used his Bitcoin-buying company as an example of how the country can show “intellectual leadership.”Saylor’s Strategy, formerly MicroStrategy, has the largest Bitcoin holdings among public companies, with 582,000 BTC worth over $61 billion according to Bitbo.Strategy has sold billions of dollars worth of debt and shares to fund its Bitcoin buys, and its share price has soared over 3,000% since its first purchase in mid-2020.