Here’s what happened in crypto today

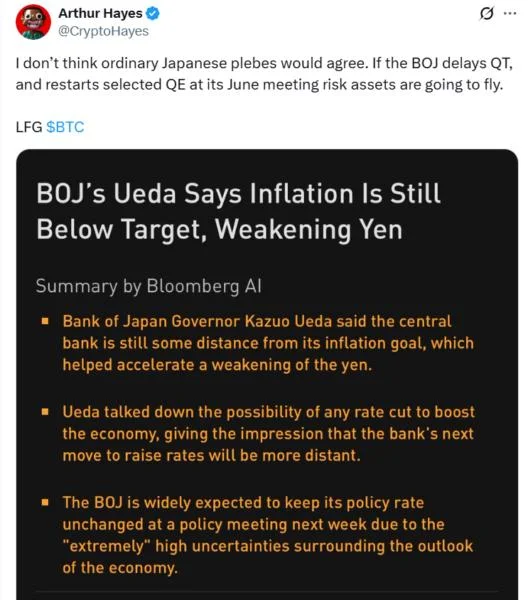

Today in crypto, the US House Agriculture Committee approved the Digital Asset Market Clarity bill, advancing the legislation further in Congress. The Bank of Japan's June meeting could trigger a Bitcoin rally if it restarts quantitative easing, and US crypto stocks and Bitcoin rose as more companies add BTC to corporate treasuries.House Agriculture Committee advances crypto market structure billLawmakers on the US House Agriculture Committee voted in favor of the Digital Asset Market Clarity, or CLARITY, Act, advancing the bill further in Congress.In a 47-6 vote on Tuesday, an overwhelming majority of lawmakers on the committee approved the CLARITY Act to establish a regulatory framework for digital assets. Committee Chair GT Thompson said the bill would be sent to the House for consideration, adding that any members offering opposing views would have the opportunity to submit them by Friday.The vote came alongside debate on the House Financial Services Committee discussing an amendment that could add protections for blockchain developers to the CLARITY Act. At the time of publication, the committee had not voted on the bill. According to its sponsors and co-sponsors, the CLARITY Act is intended to establish clear rules under which digital asset companies can operate in the United States, by also clarifying whether certain investment vehicles fall under the purview of the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). Consideration of the bill, first introduced in May, comes as the Senate is expected to vote on the GENIUS Act — legislation to regulate payment stablecoins.Bank of Japan pivot to QE may fuel Bitcoin rally — Arthur HayesThe Bank of Japan’s (BOJ) upcoming monetary policy meeting in June may provide the next significant catalyst for global risk assets like stocks and cryptocurrencies.The BoJ is set to take its next interest rate decision at its upcoming monetary policy meeting on June 16–17.The central bank may provide the next significant catalyst for Bitcoin (BTC) and other risk assets if it pivots to quantitative easing (QE), according to Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom.“If the BOJ delays QT, and restarts selected QE at its June meeting risk assets are going to fly,” Hayes wrote in a June 10 X post.QE refers to central banks buying bonds and pumping money into the economy to lower interest rates and encourage spending during difficult financial conditions.On July 31, 2024, the Bank of Japan introduced a plan to cut government bond purchases by 400 billion yen per quarter, starting in August 2024. The quantitative tightening plan is set for an interim assessment period at the upcoming meeting on June 16, signaling a potential opportunity to pivot.Bitcoin, US crypto stocks rise as more firms plan BTC buysUS crypto-linked stocks rose alongside Bitcoin to close the Monday trading day at a gain as more publicly traded firms added the asset to their treasuries. The country’s four biggest crypto miners and some major crypto firms closed at slight gains on June 10, extending gains after-hours. It comes as Bitcoin (BTC) climbed 4% over the last day to $110,150, heading back toward its May 22 peak of $112,000 as market jitters mostly subsided amid the US and China holding trade talks in the UK.Crypto and stock trading platform Robinhood Markets Inc. (HOOD) was the rare exception to the broad uptrend, sinking by nearly 2% to $73.40 after S&P Dow Jones Indices didn’t change the S&P 500’s membership on Friday.Meanwhile, Bitcoin mining equipment rental firm BitMine Immersion Technologies, Inc. (BMNR), said on Monday that it bought 100 BTC for the first time to hold in reserve and energy-management firm KULR Technology Group, Inc. (KULR) said on Monday that it bought another $13 million worth of Bitcoin, bringing its total holdings to 920 Bitcoin.