Here’s what happened in crypto today

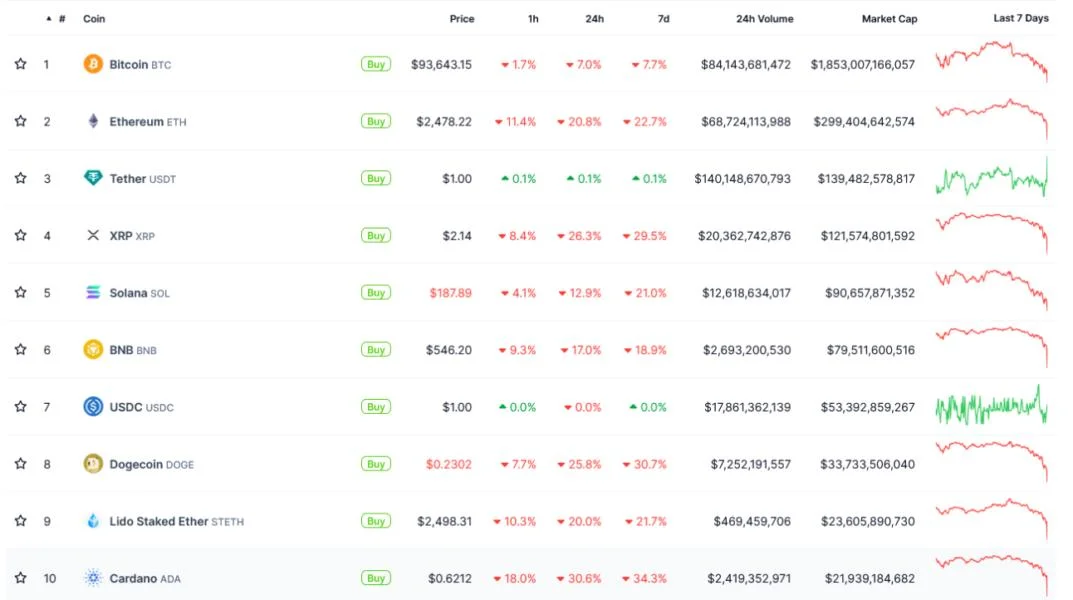

Today in crypto, several top altcoins including Ether fell double digits as the market continued to reel over Trump’s trade war. India’s government reconsiders crypto stance amid global regulatory shift and a savvy cryptocurrency trader has made nearly $16 million by capitalizing on Ether’s recent price decline.Ether, altcoins dive double digits as Trump tariffs take further tollEther and top altcoins including Cardano fell double digits in an hour as the market continued to reel from US President Donald Trump’s first round of tariffs against imports from China, Canada and Mexico.Ether , the second largest cryptocurrency by market capitalization, fell 16% in a single hour to $2,368 on Feb. 3 at 2:11 am UTC.Avalanche , XRP , Chainlink , Dogecoin and other top altcoins have fallen over 20% in the last 24 hours, contributing to an 11.4% drop in the crypto market cap to $3.17 trillion, CoinGecko data shows.10x Research founder Markus Thielen told Cointelegraph: “The sharp drop in altcoins reflects a wave of stop-loss triggers combined with a buyer’s strike from retail investors.”Thielen said trading volumes had been falling over the last few weeks, “signaling a waning appetite and lack of conviction from investors.”India reconsiders stance on crypto amid global regulatory shiftThe government of India is reconsidering its stance on crypto amid a global regulatory shift toward digital assets and increased nation-state adoption.According to Reuters, India's economic affairs secretary, Ajay Seth, said that digital assets "Don't believe in borders" and that India is reconsidering its crypto policies to avoid the risk of falling behind other countries.Seth's comments follow US President Donald Trump's recent executive order establishing the Working Group on Digital Asset Markets — an advisory body that will help shape crypto policy and explore the development of a US strategic crypto stockpile.Ethereum trader earns $16 million as ETH price falls to $3,000A savvy cryptocurrency trader has made nearly $16 million by capitalizing on Ether’s price decline.The trader generated $15.7 million worth of unrealized profit on a leveraged Ether short position, which involves “borrowing” the underlying cryptocurrency from a broker, selling it at the current price and then repurchasing it once the price falls — a strategy used by traders to bet on the price decline of an asset.The trader opened the 50x leveraged short position when ETH traded at $3,388, with a liquidation threshold of $4,645, Hypurrscan data shows.The trader earned an additional $2.3 million worth of funding fees on their leveraged position.While leveraged trading can potentially increase returns, it can significantly amplify downside risks and lead to the loss of the initial investment.In January 2024, a pseudonymous trader lost over $161,000 worth of funds in a single trade after being liquidated on a leveraged position, illustrating the risks of leveraged trading.