Here’s what happened in crypto today

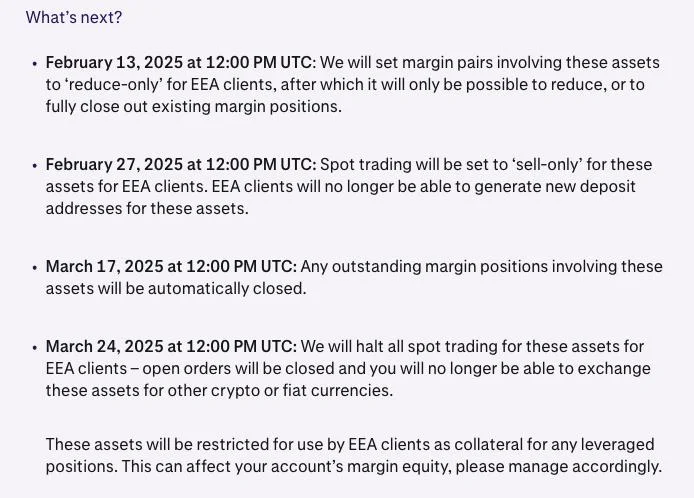

Today in crypto, Kraken announced that it will delist Tether’s USDt and four other stablecoins in Europe to comply with the Markets in Crypto-Assets Regulation (MiCA), asset manager 21Shares has filed with the US Securities and Exchange Commission to launch a spot Polkadot exchange-traded fund (ETF), and crosschain protocol LayerZero has settled with the FTX estate over transactions involving Alameda Research in 2022.Kraken to delist USDT and four other stablecoins in EuropeCryptocurrency exchange Kraken is moving to comply with European crypto regulations by preparing to delist five stablecoins, including Tether’s USDt.Kraken will fully delist USDt on March 31 to comply with the European Union’s Markets in Crypto-Assets Regulation (MiCA), according to an official announcement by the exchange.Alongside USDT, the exchange will gradually remove support for PayPal USD (PYUSD), Tether EURt (EURT), TrueUSD (TUSD), and TerraClassicUSD (UST) in the European market.“These changes ultimately ensure Kraken remains compliant and is able to provide its exceptional trading experience to European clients for the long term,” the company said.In line with the provisions set by the European Securities and Markets Authority (ESMA) to ensure a smooth and orderly delisting process, Kraken will drop USDT support in stages.First, Kraken will set margin pairs involving the affected assets to “reduce-only” mode for clients in the European Economic Area (EEA) on Feb. 13. Following this restriction, EEA users will be only able to reduce or fully close out existing margin positions.By Feb. 27, Kraken will put the affected tokens in “sell-only” mode, restricting EEA clients from generating deposit addresses for tokens like USDT but still supporting trading.On March 24, Kraken will halt all spot trading for the affected assets, closing all open orders and exchanges into other coins or fiat currencies.21Shares files with SEC for spot Polkadot ETFAsset management firm 21Shares has filed with the US Securities and Exchange Commission (SEC) to launch a spot Polkadot exchange-traded fund (ETF).In a Jan. 31 SEC filing, 21Shares stated its intention to list the 21Shares Polkadot (DOT) Trust on the Cboe BZX exchange, with cryptocurrency exchange Coinbase acting as the DOT custodian.It comes just four years after 21Shares launched a similar product in Switzerland. In Feb 2021, the asset manager launched the world’s first Polkadot ETP on the Swiss SIX exchange.DOT is the 18th largest crypto by market capitalization, but its price performance has been underwhelming in recent times. Over the past 12 months, its price has fallen 5.16%, and it’s down 10.48% in the last month, according to CoinMarketCap data.The filing warned that there’s no guarantee of Polkadot’s price performance, either in the short or long term, after the ETF launches.“There is no assurance that DOT will maintain its value in the long or intermediate term,” the filing said.LayerZero CEO announces settlement with FTX estateBryan Pellegrino, the CEO of LayerZero Labs, has confirmed that the crosschain protocol reached a settlement with defunct cryptocurrency exchange FTX involving transactions dating back to 2022.In a social media post, Pellegrino said his firms spent “millions in legal fees” and two years in litigation to resolve the dispute over transactions involving Alameda Research before FTX’s collapse in November 2022. Ultimately we decided this was not us vs FTX which is a fight we feel completely justified in, but it was us vs the creditors (which also we are one of),” said Pellegrino. “Original repurchase has been returned to the estate.”Alameda Ventures had agreed to purchase a 5% stake in LayerZero in 2022, which included a $70 million payment and a $25 million acquisition of STG tokens. Following the collapse of FTX and its sister company, Alameda Research, LayerZero sought to reacquire its equity in exchange for forgiving a $45-million loan to FTX. However, the FTX estate sued LayerZero in September 2020, alleging that the company “negotiated a fire-sale transaction” with former Alameda CEO Caroline Ellison.