Here’s what happened in crypto today

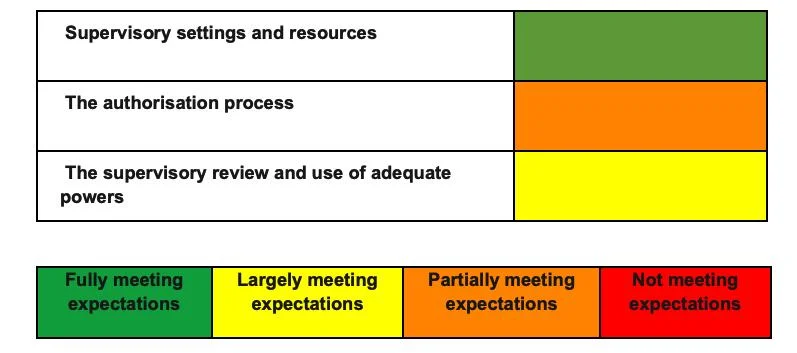

Today in crypto, Malta’s cryptocurrency licensing process has come under scrutiny from the European Securities and Markets Authority (ESMA), GMX has paused trading after a liquidity pool exploit drained over $40 million, and the US has sanctioned a North Korean IT worker ring accused of targeting American companies.Malta’s MiCA licensing comes under scrutiny from EU regulatorThe ESMA on Thursday released a review of the authorization process of crypto asset service providers (CASPs) by Malta’s Financial Services Authority (MFSA), highlighting several shortfalls and proposing a set of recommendations.Despite saying the MFSA met certain expectations in supervisory setup and staffing, the EU watchdog said the Maltese authorities only “partially met expectations” in the authorization process for an unidentified CASP.Following the review, the ESMA’s ad hoc Peer Review Committee (PRC) recommended that MFSA “assess material issues that were pending at the date of the authorization or that have not been adequately considered at the authorization stage.”The report comes over a year after the MiCA framework came into force on June 29, 2024, becoming a major milestone in the EU’s approach to regulating digital assets.Since MiCA is aimed at providing a unified and consistent legal framework for crypto in the EU, the regulator highlighted that MiCA’s authorization approach applies to all National Competent Authorities (NCAs).While fully meeting the supervisory settings requirements and largely meeting the supervisory review rules, the report said the MFSA has only “partially met expectations” relevant to the “authorization of the specific CASP.”Malta’s MFSA “needs to monitor closely the growth in authorization applications” and identify and adjust supervisory practices in a timely manner, the PRC said.Binance founder’s family office backs BNB treasury firm eyeing IPOBinance co-founder Changpeng Zhao’s family office is set to back a new treasury firm that will offer investors exposure to BNB, with plans to to go public in the US.YZi Labs said on Wednesday it will support the investment firm 10X Capital in spinning up a BNB (BNB) treasury company that will pursue a listing on “a major US exchange,” according to a statement shared with Cointelegraph.Mentioned only as the “BNB Treasury Company,” the firm will appoint David Namdar as CEO. He’s a senior partner at 10X Capital and a co-founder of Galaxy Digital, where he was formerly co-head of trading. 10X Capital will serve as the asset manager of the planned BNB buying company.The planned company is the latest in a trend of firms buying up large amounts of cryptocurrencies, such as Bitcoin (BTC), providing Wall Street a vehicle for exposure to digital assets.GMX halts trading, token minting following $40 million exploitThe GMX protocol halted trading on GMX V1 after a liquidity pool suffered an exploit on Wednesday, leading to $40 million in funds being stolen and sent to an unknown wallet.GMX V1 is the first version of the GMX perpetual exchange deployed on the Arbitrum network. The attacked pool is a liquidity provider for the GMX protocol with a basket of underlying digital assets including Bitcoin (BTC), Ether (ETH) and stablecoins, according to the GMX team.The protocol has also announced a temporary suspension in minting and redemption of GLP tokens on both Arbitrum and the layer-1 Avalanche network to protect against any additional fallout from the cybersecurity exploit.Users of the platform were instructed to disable leverage and change their settings to disable GLP minting.Blockchain security company SlowMist attributed the exploit to a design flaw that allowed hackers to manipulate the GLP token price through the calculation of the total assets under management.