Here’s what happened in crypto today

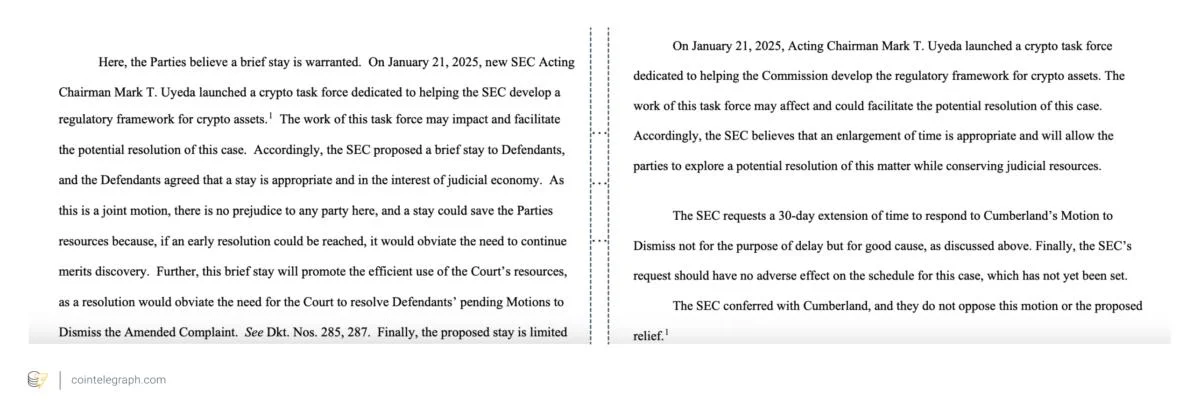

Today in crypto, the US Securities and Exchange Commission (SEC) is seeking more time to resolve enforcement cases against crypto firms, citing the potential impact of its newly formed Crypto Task Force on its legal strategy. This shift has already resulted in a Feb. 10 joint motion with Binance to pause a dispute. Meanwhile, analysts estimate a 90% probability of a Litecoin exchange-traded fund (ETF) approval this year.SEC invokes crypto task force to request delay in enforcement casesThe US Securities and Exchange Commission requested more time to respond to a motion to dismiss one of the agency’s crypto enforcement cases, citing how its recently created crypto task force could affect its approach in court. In a Feb. 10 filing in the US District Court for the Northern District of Illinois, the SEC requested a judge push its deadline to respond to Cumberland DRW’s motion to dismiss from Feb. 19 to March 21. According to the financial regulator, its crypto task force “may affect and could facilitate the potential resolution of [the] case.”“[...] the SEC believes that an enlargement of time is appropriate and will allow the parties to explore a potential resolution of this matter while conserving judicial resources,” said the commission.SEC and Binance seek 60-day pause in crypto caseThe US SEC and Binance filed a joint motion to pause their legal case for 60 days, marking the first move toward halting major cryptocurrency litigation since Mark Uyeda took over as acting SEC chair.The motion, filed on Feb. 10, asked to pause the case against the exchange for 60 days, citing the establishment of the SEC’s Crypto Task Force.“The work of this task force may impact and facilitate the potential resolution of this case,” the SEC and Binance wrote in the motion.According to some industry observers, other crypto firms like Ripple, Coinbase and Kraken will likely follow suit by filing similar joint motions with the SEC.Following the 60 days, the SEC and Binance plan to issue a joint report on whether a continuation of the stay would be warranted.“As this is a joint motion, there is no prejudice to any party here, and a stay could save the parties resources because, if an early resolution could be reached, it would obviate the need to continue merits discovery,” the parties said.Analysts tip 90% chance Litecoin ETF will be approved in 2025Bloomberg exchange-traded fund (ETF) analysts have tipped a 90% chance that the US securities regulator will approve a spot Litecoin ETF before the end of the year. Bloomberg’s James Seyffart and Eric Balchunas see its chances of being approved in 2025 as higher than other ETFs currently proposed, including a spot XRP (XRP), Solana (SOL) and Dogecoin (DOGE) ETF — which they see as having a 65%, 70% and 75% chance respectively. Posting on X, the pair said that Litecoin’s path toward SEC approval may be the most straightforward as S-1 and 19b-4 forms have already been filed and acknowledged, while the SEC also likely views it as a commodity.