Here’s what happened in crypto today

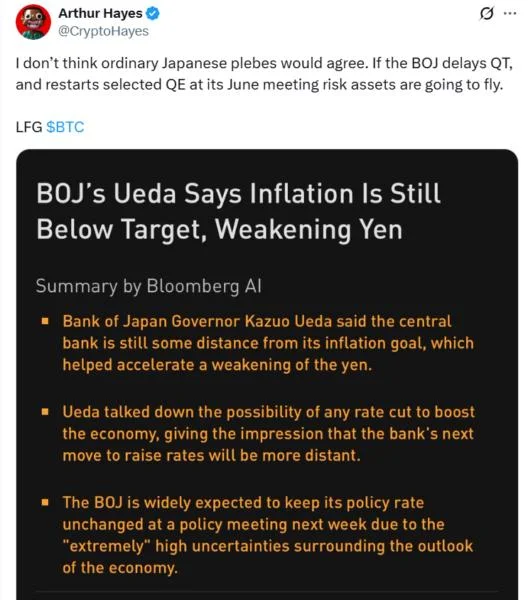

Today, in crypto, Arthur Hayes said the Bank of Japan’s June meeting could trigger a Bitcoin rally if it restarts quantitative easing, US crypto stocks and Bitcoin surged as more companies added BTC to their corporate treasuries, and Paraguay’s president denied claims that Bitcoin will become legal tender in the country.Bank of Japan pivot to QE may fuel Bitcoin rally — Arthur HayesThe Bank of Japan’s (BOJ) upcoming monetary policy meeting in June may provide the next significant catalyst for global risk assets like stocks and cryptocurrencies.The BoJ is set to take its next interest rate decision at its upcoming monetary policy meeting on June 16–17.The central bank may provide the next significant catalyst for Bitcoin and other risk assets if it pivots to quantitative easing (QE), according to Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom.“If the BOJ delays QT, and restarts selected QE at its June meeting risk assets are going to fly,” Hayes wrote in a June 10 X post.QE refers to central banks buying bonds and pumping money into the economy to lower interest rates and encourage spending during difficult financial conditions.On July 31, 2024, the Bank of Japan introduced a plan to cut government bond purchases by 400 billion yen per quarter, starting in August 2024. The quantitative tightening plan is set for an interim assessment period at the upcoming meeting on June 16, signaling a potential opportunity to pivot.Bitcoin, US crypto stocks rise as more firms plan BTC buysUS crypto-linked stocks rose alongside Bitcoin to close the Monday trading day at a gain as more publicly traded firms added the asset to their treasuries. The country’s four biggest crypto miners and some major crypto firms closed at slight gains on June 10, extending gains after-hours. It comes as Bitcoin (BTC) climbed 4% over the last day to $110,150, heading back toward its May 22 peak of $112,000 as market jitters mostly subsided amid the US and China holding trade talks in the UK.Crypto and stock trading platform Robinhood Markets Inc. (HOOD) was the rare exception to the broad uptrend, sinking by nearly 2% to $73.40 after S&P Dow Jones Indices didn’t change the S&P 500’s membership on Friday.Meanwhile, Bitcoin mining equipment rental firm BitMine Immersion Technologies, Inc. (BMNR), said on Monday that it bought 100 BTC for the first time to hold in reserve and energy-management firm KULR Technology Group, Inc. (KULR) said on Monday that it bought another $13 million worth of Bitcoin, bringing its total holdings to 920 Bitcoin.Paraguay warns of “irregular activity” after post claiming BTC is legal tenderThe office of Paraguayan President Santiago Peña appeared to deny a post on the social media platform X that announced the country would begin recognizing Bitcoin as legal tender.In a Monday post on X, the official account of the office of Paraguay’s president asked followers to “dismiss any recently published content” without official confirmation from his office.The post was made minutes after Peña’s personal account on X announced (in English) that Paraguay had made Bitcoin (BTC) legal tender, and established a BTC reserve worth $5 million, also providing a wallet address for investors to “secure [their] stake.”At the time of publication, Peña’s personal post had been removed, while the government post was still live on the platform. The president’s office said it was working with the social media platform to “clarify the situation” and for the public to only consider information issued through official channels. The X post came as some countries in Central and South America were reportedly considering following El Salvador’s example by adopting Bitcoin as a reserve asset.