Here’s what happened in crypto today

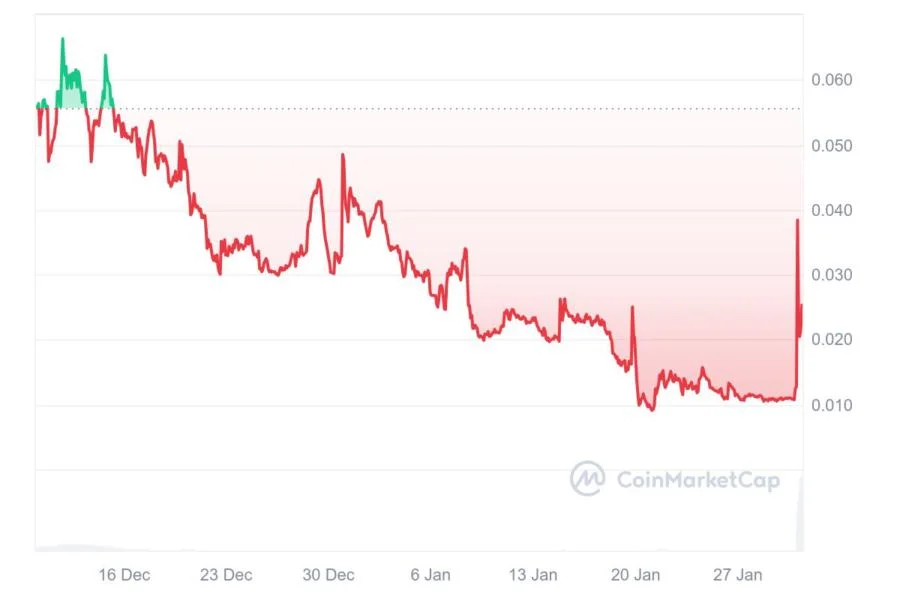

Today, in crypto, crosschain protocol LayerZero settled with the FTX estate over transactions involving Alameda Research in 2022, Elon Musk’s father, Errol Musk, is reportedly looking to raise $200 million through a memecoin token project called Musk It (MUSKIT), and Bitwise’s Bitcoin and Ether ETF cleared its first regulatory hurdle.LayerZero settles with FTXBryan Pellegrino, the CEO of LayerZero Labs, has confirmed that the crosschain protocol reached a settlement with defunct cryptocurrency exchange FTX involving transactions dating back to 2022.In a social media post, Pellegrino said his firms spent “millions in legal fees” and two years in litigation to resolve the dispute over transactions involving Alameda Research before FTX’s collapse in November 2022. Ultimately we decided this was not us vs FTX which is a fight we feel completely justified in, but it was us vs the creditors (which also we are one of),” said Pellegrino. “Original repurchase has been returned to the estate.”Alameda Ventures had agreed to purchase a 5% stake in LayerZero in 2022, which included a $70 million payment and a $25 million acquisition of STG tokens. Following the collapse of FTX and its sister company, Alameda Research, LayerZero sought to reacquire its equity in exchange for forgiving a $45-million loan to FTX. However, the FTX estate sued LayerZero in September 2020, alleging that the company “negotiated a fire-sale transaction” with former Alameda CEO Caroline Ellison.Elon Musk’s dad plans $200M raise with ‘Musk It’ memecoinJoining the ranks of US President Donald Trump, Elon Musk’s father, Errol Musk, is reportedly looking to launch his own memecoin token project called Musk It (MUSKIT).Musk’s father hopes to raise as much as $200 million from the memecoin project, which he plans to use to support a for-profit think tank called the Musk Institute, he told Fortune.While the Musk It token was silently launched on Dec. 12, 2024, the token failed to gain significant traction, shedding over 52% of its value since launch, to trade at $0.02 with a $25 million market capitalization.SEC gives initial nod to Bitwise’s Bitcoin and Ethereum ETFThe US Securities and Exchange Commission on Jan. 30 gave initial approval to Bitwise’s exchange-traded fund (ETF) tracking the price of Bitcoin (BTC) and Ether (ETH).The regulator approved a form 19b-4 for the “Bitwise Bitcoin and Ethereum ETF” — the first step in a process to allow the ETF to start trading. The SEC will also need to approve what’s known as a Form S-1 for the fund to go live.The fund aims to give exposure to the spot price of both BTC and ETH, weighing each according to each asset’s relative market capitalization, which was 83% BTC and 17% ETH as of the day of filing.The approval comes days after a new crypto-friendly acting chair was appointed to lead the SEC. Bitwise submitted for the joint ETF to regulators in November after Donald Trump’s election win.It’s the third joint BTC and ETH spot fund to be given SEC approvals. The regulator gave the green light to similar ETFs from Hashdex and Franklin Templeton last month.