Here’s what happened in crypto today

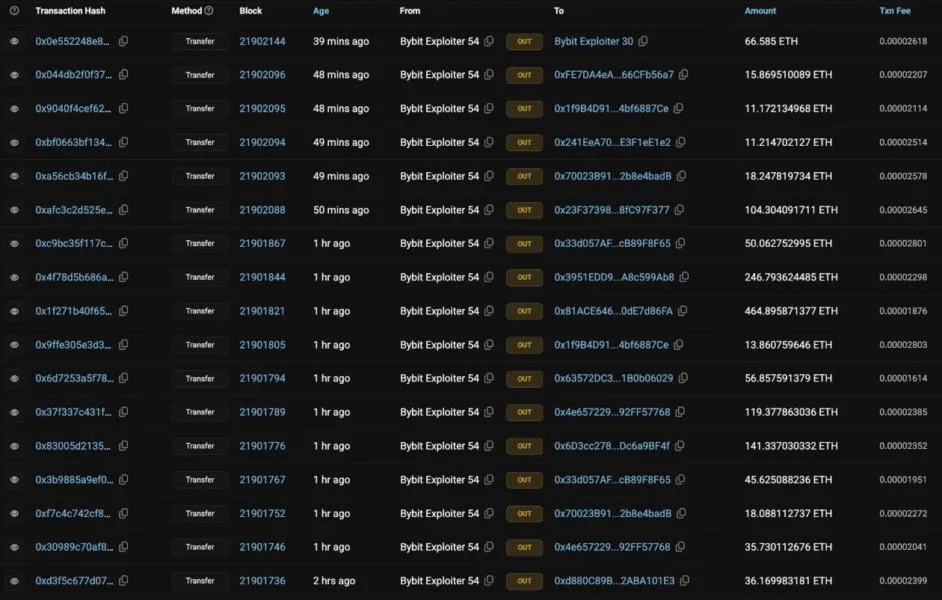

Today in crypto, Bybit announced bounty program to recover stolen funds, Bybit fell victim to the biggest hack in crypto history, with North Korean hackers stealing over $1.4 billion in assets. Bybit’s assets have fallen by more than $5 billion since the Feb. 21 hack, but independent audits have confirmed its reserves still exceed liabilities, ensuring full backing for user funds, and Bybit was hacked for $1.4 billion.Bybit announces bounty program to recover stolen fundsThe Bybit exchange has announced a bounty program of up to 10% of the stolen funds, or roughly $140 million, to white hat hackers aiding in the return of the crypto seized by the infamous Lazarus hacker group.Ben Zhou, CEO of Bybit, also said the centralized trading platform is exploring multiple avenues to recover the funds, including working with law enforcement officials and discussing further steps with Vitalik Buterin of the Ethereum Foundation.As part of the massive outpouring of support from crypto industry firms and executives, Tether CEO Paolo Ardoino announced that the stablecoin issuer froze 181,000 USDt .The official announcement of a bounty program came amid the Lazarus Group moving crypto between dozes of wallets to launder the stolen funds.Bybit withdrawals top $5.3B, but ‘reserves exceed liabilities’ — Hacken Cryptocurrency exchange Bybit has maintained reserves exceeding its liabilities despite suffering a $1.4 billion hack and an overall $5.3 billion decline in total assets, according to DefiLlama data.The Feb. 21 hack marked the largest crypto theft in history, with attackers stealing more than $1.4 billion in liquid-staked Ether (STETH), Mantle Staked ETH (mETH) and other ERC-20 tokens.Since the incident, the value of Bybit’s total assets has fallen by over $5.3 billion, including the $1.4 billion lost to the hack, DefiLlama data shows.Despite the hack and drop in assets, Bybit’s exchange reserves still exceed its liabilities, according to its independent Proof-of-Reserve (PoR) auditor, Hacken. In a Feb. 21 post on X, Hacken confirmed:“Today’s hack was massive—a tough hit for the industry. But here’s the bottom line: Bybit’s reserves still exceed its liabilities. As their independent PoR auditor, we’ve confirmed that user funds remain fully backed.”Bybit exchange hacked, over $1.4B in ETH-related tokens drainedCryptocurrency exchange Bybit has been hacked for over $1.4 billion in liquid-staked Ether (stETH), Mantle Staked ETH (mETH) and other ERC-20 tokens, according to onchain security analyst ZachXBT, who spotted the incident shortly after it occurred.Following the exploit, the onchain sleuth warned users to blacklist addresses associated with the hack. The North Korean hacker organization Lazarus Group was spotted behind the hack.Bybit co-founder and CEO Ben Zhou confirmed the incident and provided an update on the security breach.Zhou confirmed that a transfer was made from the exchange’s multisignature wallet to a warm wallet approximately one hour prior.The CEO said the specific transaction was masked to appear legitimate but contained malicious source code designed to alter the smart contract logic of the wallet and siphon funds. Zhou reassured customers:“Please rest assured that all other cold wallets are secure. All withdrawals are NORMAL. I will keep you guys posted as more develops. If any team can help us to track the stolen fund will be appreciated.”Later in a livestream, Zhou said that the exchange had around 4,000 pending withdrawal transactions and asked for patience as the issue is resolved. The CEO added:“We don’t have plans to suspend or cancel withdrawals. At the moment, we are still receiving all the withdrawal requests, and, in fact, 70% of them have been approved and processed. A lot of the network congestion is still there, so we’re processing them as fast as we can.”The CEO also reassured customers that no other Bybit wallet was compromised in the security incident and added that the exchange is securing a bridge loan to continue operations while the issue is fully resolved.