GameStop completes meme-stock evolution

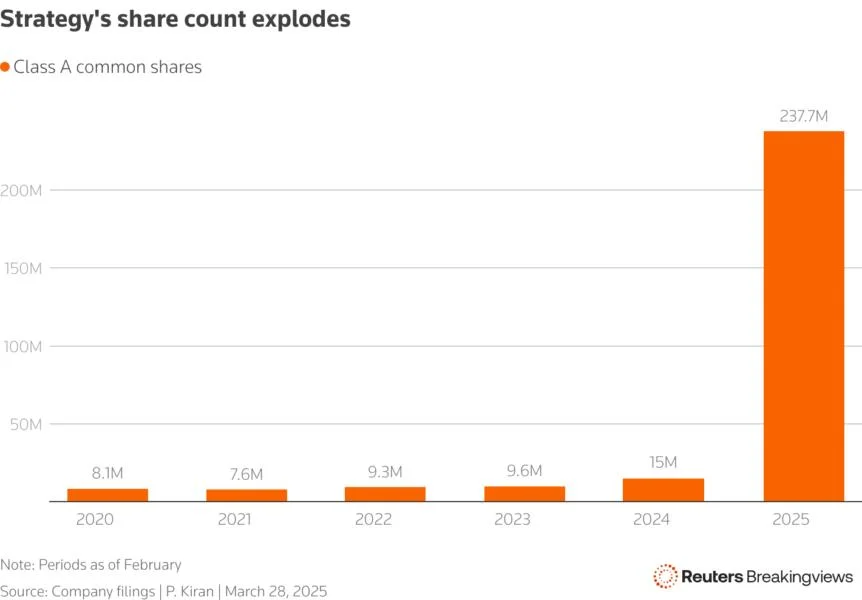

In the Pokemon video games, players nurture digital creatures as they evolve through three distinct stages. GameStop , ostensibly a $10 billion game retailer, is experiencing something similar. On Thursday, it priced a $1.3 billion offering of bonds that can convert into shares. It intends to use the proceeds to buy bitcoin, reaching what now seems like the logical final step for companies inspiring retail trader mania: turning those investors into a hedge-fund product.“Meme stocks,” or companies whose valuation untethers from economic reality, now have a template. First, take a struggling business with dour prospects. Strategy , the debt-for-bitcoin pioneer run by Michael Saylor, saw its heyday during the dotcom bubble and has not grown in a decade. GameStop is a brick-and-mortar vendor of video games, fewer than 5% of which are now purchased offline.Such companies struggle to attract sophisticated investors. But day traders flush with cash and time during the pandemic added a big new force in the market. The average daily trading volume of U.S. equities climbed 62% in 2020’s first quarter thanks to retail participation, staying elevated ever since, according to CBOE data. Add in nostalgia for a game-playing youth and a rhetorical vendetta against “short-selling hedge funds” trying to crush its memory, and GameStop inspired a community on message boards like Reddit. This is the second stage: the company’s share price shot up by 20 times at its height.A meme company can start to benefit here by raising capital through share sales. Theater chain operator AMC Entertainment raised $1.8 billion in 2021 alone. Diluting existing investors and maintaining enthusiasm is finicky, though. The ideal would be to harvest meme stocks’ raw volatility directly.Convertible debt is the answer, and this final evolutionary stage is mapped out by Strategy, formerly known as MicroStrategy. Risk-savvy hedge funds buy the bonds and sell the underlying shares short, protecting them in both directions. To them, it matters less where the share price goes, more that it simply moves a lot. Using proceeds to purchase bitcoin helps, since it levers up an already-volatile asset. Strategy’s shares are 3.5 times more volatile than the broader market, according to LSEG data.It’s imperative that shares be affordable to borrow and sell short. Dilution and stock splits, increasing the pool of available stock, are now a virtue. In the five years that Strategy has hoarded bitcoin, its class A common stock count has risen nearly thirty-fold. This all runs on the steady churn of retail traders hanging on for the ride. Message-board investors once inveighed against hedge funds as they piled into meme trades. Now, they’re doing them a favor. Follow @PranavKiranBV on XCONTEXT NEWS GameStop announced on March 27 that it had priced an offering of $1.3 billion of convertible debt. The company expects to use the proceeds for general corporate purposes, including the acquisition of bitcoin.Initial purchasers would also get an option to buy an additional $200 million of the notes within a certain period, according to the company’s announcement.