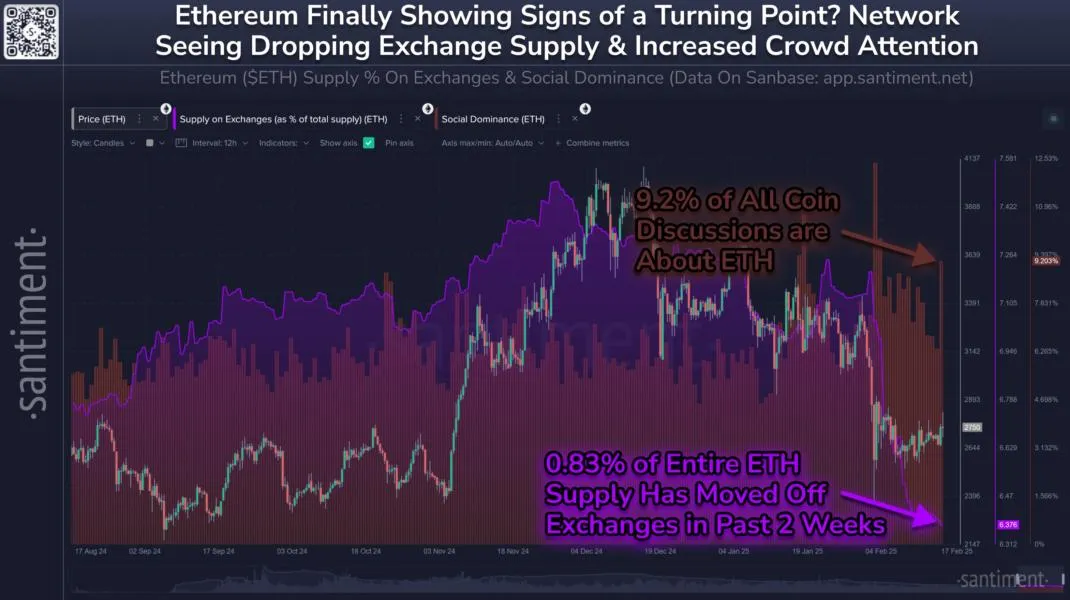

Ethereum shows signs of life as holders move ETH off exchanges: Santiment

Ethereum prices have outperformed the broader crypto market over the past 24 hours in a rare move that resulted in a 12-day high, indicating “mild signs” of a rebound, according to Santiment.“Ethereum has shown mild signs of a rebound … and outpacing most altcoins to start the week,” crypto analysts at Santiment wrote on Feb. 18. Ether hit an intraday and 12-day high of $2,832 on Feb. 17 but failed to maintain that momentum, falling back to $2,720 in early trading on Feb. 18. ETH has gained 2% on the day, whereas the wider crypto market has retreated 2.4% in terms of total capitalization. Santiment added that from a long-term perspective, “ETH continues to move off of exchanges and into cold wallets at a shocking pace,” with just 6.38% of the available supply remaining on exchanges. When crypto assets move off centralized exchanges, it is usually a signal that investors are hodling. It “decreases the probability of a major upcoming sell-off. But it should be considered a long-term metric, rather than one to react to on a swing trading basis,” said Santiment. The analysts also commented that the community has been showing some renewed interest in Ethereum in February following prolonged lackluster performance. “After being a major under-performer relative to other large caps in 2024, there has been some anticipation of a rebound when market-wide recoveries begin to take place.”Not all were convinced, however, with crypto YouTuber Lark Davis quipping that “Ethereum pumps a few percent, and then markets dump five minutes later.”The move has also improved the ETH/BTC ratio slightly, which is a measure of the price of Ether in terms of Bitcoin . This metric has been at multi-year lows as ETH has lost ground to BTC since mid-2022. The ratio improved by 7% on Feb. 17 to reach 0.029, but it has remained close to its weakest levels since December 2020, according to TradingView.