Ethereum network growth, spot ETH ETF inflows and price gains lure new investors

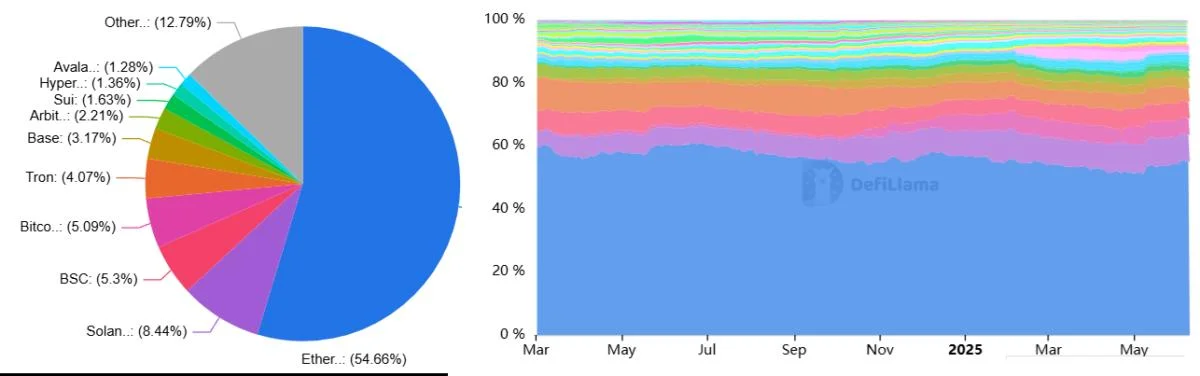

Key takeaways: ETH’s price gains are driven by an uptick in network activity and robust spot ETF inflows. Data suggests $2,800 will remain a difficult hurdle for ETH to overcome.Ether has traded within a relatively narrow range between $2,370 and $2,770 since May 10, yet several indicators suggest potential for upward movement. Ethereum continues to lead the blockchain space in both deposits and activity when its layer-2 scaling solutions are included in the analysis.Despite Ether's failure to reclaim its all-time high during the 2024–25 cycle, none of the so-called Ethereum killers have come close to matching its $66.6 billion in total value locked (TVL). Ethereum currently holds a dominant 61% share of the market, while the two largest competitors together account for only 14%.The TVL of Ethereum’s base layer grew 6% over the past 30 days, led by gains from Pendle, Ethena, and Spark. In contrast, BNB Chain saw a 6% decline, and Solana’s deposits dropped by 2%. More importantly, the surge in deposits across competing blockchains during the memecoin frenzy earlier in 2025 has proven to be unsustainable.Ethereum did lose ground in decentralized exchange (DEX) volumes due to high base layer fees, which remain a barrier for most users. However, its layer-2 solutions collectively recorded an impressive $70 billion in DEX activity over 30 days, maintaining Ethereum’s lead across the ecosystem. Notable contributors include Base, Arbitrum, Unichain, and Polygon.Interestingly, some networks that once aimed to challenge Ethereum’s dominance with base-layer scalability are now absent from the top six in DEX activity. For example, Tron reportedly posted just $4.5 billion in 30-day volume, while Avalanche recorded $4.2 billion. By contrast, Ethereum and its scaling solutions totaled $136.8 billion.Critics of Ether have raised concerns about Ethereum’s sustainability, pointing to its modest $43.3 million in chain fees over 30 days. Recent network updates have prioritized benefits for rollups, introducing large, low-cost temporary data packets known as blobs. As a result, returns for stakers have been negatively impacted, since ETH’s supply reduction largely depends on network fees.Beyond its onchain dominance, Ether remains the only altcoin with approved spot exchange-traded funds (ETFs) in the United States. This advantage has helped solidify a $10 billion market, while competitors like Solana and XRP still await decisions from the US Securities and Exchange Commission. Analysts expect a final ruling by mid-October.Since May 16, the spot ETH ETFs have not recorded a single day of net outflows, amassing $837 million in net inflows during the period. While this buying pressure may appear modest compared to the $4 billion in average daily ETH volume on major exchanges, it signals growing institutional interest.Ether’s short-term supply, as measured by exchange deposits, has fallen to a record low near 16.33 million ETH. Simultaneously, 28.3% of the total Ether supply is now locked in staking, a dynamic that supports positive price moves when demand increases.The sharp 48% ETH rally between May 7 and May 14 underscores the imbalance between holders and potential buyers. Considering Ethereum’s onchain metrics and rising spot ETF demand, a breakout above $2,800 in the near term seems likely.This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.