Ethereum labeled ‘standout performer’ as global crypto funds add $785 million in fifth straight week of inflows: CoinShares

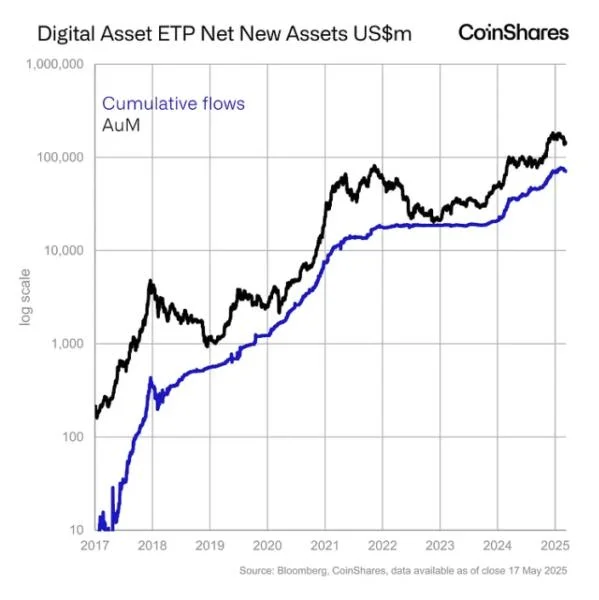

Crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered $785 million worth of net inflows globally last week, according to CoinShares data — boosted by recovering Ethereum sentiment.It marks the fifth consecutive week of gains, with year-to-date inflows now standing at $7.5 billion — surpassing the previous peak of $7.2 billion recorded in early February, CoinShares Head of Research James Butterfill wrote in a Monday report. "It also fully recovers the near $7 billion of outflows experienced during the February-March price correction," he said.Weekly crypto asset flows. Images: CoinShares.In a week that saw bitcoin consolidate between $102,000 and $105,000, according to The Block's Bitcoin price page, while ether fell around 3%, and the GMCI 30 index of leading cryptocurrencies dropped 6%, total assets under management at the funds reached $172.9 billion — again around record levels.Ethereum sentiment is recoveringWhile Bitcoin-based funds again dominated last week, accounting for $557 million in net inflows, Ethereum investment products were the "standout performer," in Butterfill's view — adding $205 million to reach $575 million year-to-date as sentiment toward the second-largest cryptocurrency continues to recover.The Ethereum flows indicate renewed investor optimism following its successful Pectra upgrade and the appointment of new co-executive director Tomasz Stańczak, Butterfill said. However, the U.S. spot Ethereum exchange-traded funds represented just $41.8 million of this figure, according to data compiled by The Block, with sentiment divided across regions.The Bitcoin fund flow figures represent a decrease from $887 million during the prior week — likely due to continued hawkish signals from the U.S. Federal Reserve, Butterfill added. Short-bitcoin products also registered a fourth consecutive week of inflows, totalling $5.8 million, reflecting investor positioning amid recent price gains, he said.The U.S., Germany, and Hong Kong markets attracted overall net inflows of $681 million, $86.3 million, and $24.2 million, respectively — with Hong Kong marking its largest inflow since November 2024, Butterfill noted. However, digital asset investment products in Sweden, Canada, and Brazil saw outflows of $16.3 million, $13.5 million, and $3.9 million.Meanwhile, Solana-based investment products were the only ones to witness net outflows last week, with a modest $0.9 million exiting the funds.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.