Ethereum Flashes Bullish Divergence – Is A Rally On The Horizon?

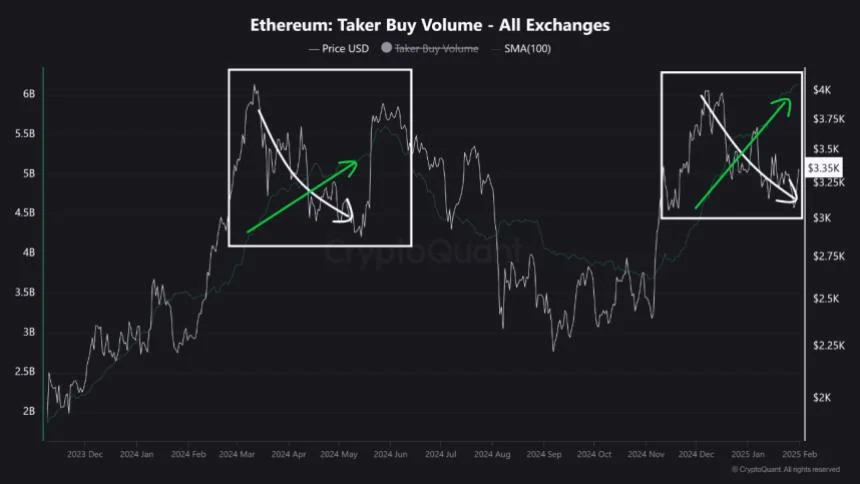

The price of Ethereum (ETH) has shown some significant change in the past day rising by 1.86%. However, according to trading data from CoinMarketCap, the popular altcoin has recorded negative growth since December 2024 despite some significant gains in the past month. Interestingly, underlying market activity points to a potential price breakout. Ethereum Sees Strong Accumulation Activity Amid Price DipEver since touching the $4,000 price mark, Ethereum has slipped into a downtrend falling as low as $3,000. Amidst notable gains by Bitcoin in January, Ethereum continues to struggle hitting consistent lower lows during this period.However, a CryptoQuant market expert with the username Crypto Sunmoon has noted an increase in market buying volume amidst the current price dip indicating a bullish divergence in the ETH market. For context, a bullish divergence occurs when an asset’s price is making lower lows while a momentum indicator is making higher lows, thereby hinting at a potential reversal or upward movement.As for Ethereum, the increase in buying volume amid falling prices indicates a strong demand from buyers especially at the current price levels. This development further suggests a strong confidence in the asset’s profitability as investors expect buying pressure to surpass selling activity in the coming days.Based on historical data, Crypto Sunmoon predicts Ethereum may experience a price surge such as the one in May 2024 when a similar bullish divergence last occurred. During that month, ETH rose by over 21% suggesting the altcoin will likely return to $4,000 if the projected price breakout occurs, according to current market prices. ETH Long-Term Holders Signal Strong Market Confidence In other news, IntoTheBlock reports that long-term holders of Ethereum currently boast an average holding time of 2.4 years showing massive confidence in Ethereum’s future value potential.However, Ethereum faces other issues including an absence of short-term participants which prevents ETH from experiencing significant levels of speculative trading that can drive up price appreciation. Furthermore, the rapid growth of layer 2 solutions such as Optimism, and layer 1 blockchains such as Solana are also tampering with the potential market demand and attention for Ethereum.At press time, ETH trades at $3,306 after a gain of 1.86% over the past day as earlier stated. Meanwhile, the asset’s daily trading volume has increased by 55.69% resulting in a value of $30.3 billion. On larger time frames, Ethereum is also up by 0.22% on its weekly chart but down by 2.27% on its monthly chart leaving much to desire for many short-term investors.