Dollar jumps on Trump tariff talk

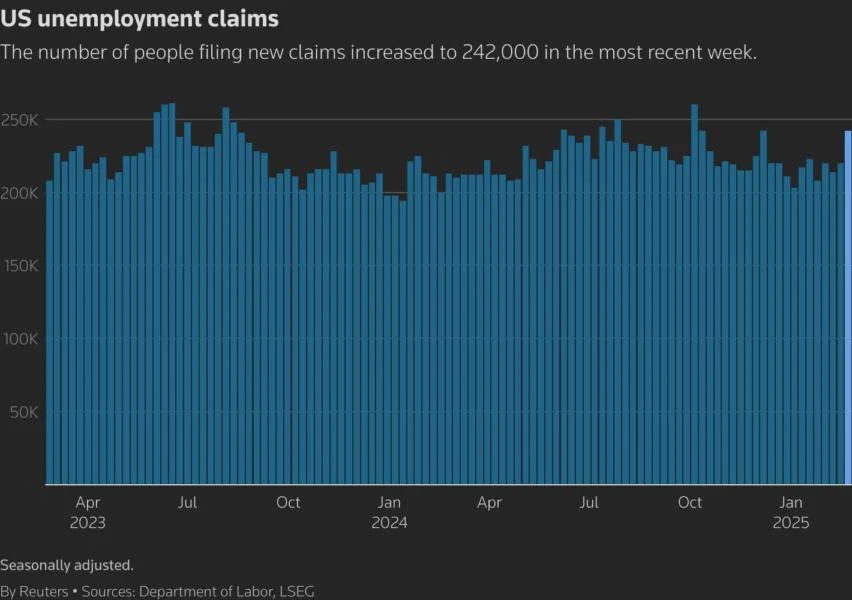

The dollar jumped on Thursday, on track for its biggest daily percentage gain in nearly two months, as U.S. President Donald Trump's latest tariff comments overshadowed signs of slower economic growth.The greenback initially pared gains after data showed weekly initial jobless claims rose by 22,000 to a seasonally adjusted 242,000, above the 221,000 estimate of economists polled by Reuters. However, the Commerce Department said gross domestic product increased at a 2.3% annualized rate last quarter after accelerating at a 3.1% pace in the July-September quarter in its second estimate of the data. The dollar quickly rebounded after Trump said 25% tariffs on Mexican and Canadian goods will go into effect on March 4 as scheduled because drugs are still pouring into the U.S. from those countries. "The moves this morning I think are understandable if you consider people have come into last week and even this week, repositioning for a softer tariff position," said Erik Bregar, director of forex & precious metals risk management, at Silver Gold Bull in Toronto. "The clarification has thrown a wrench into your trade. I don't think this morning's move, the dollar spiking, is people jumping aboard a new trade. They are getting out. It's more of a panicky 'get me out' kind of move." The dollar index , which measures the greenback against a basket of currencies, rose 0.65% to 107.14, on track for its biggest daily percentage gain since January 2. The euro fell 0.65% to $1.0415.The Canadian dollar weakened 0.62% versus the greenback to C$1.44 and the Mexican peso was down 0.17% versus the dollar at 20.482. Earlier this week, the greenback had fallen nearly 4% from a more than two-year high in January on renewed worries about U.S. economic growth and inflation as Trump shifted tariff deadlines on Canada and Mexico. Investors are also bracing for the labor market impact from actions by the Department of Government Efficiency under Elon Musk. The path of interest rate cuts by the Federal Reserve has become less clear, with markets pricing in 55 basis points of easing by year-end, and a cut of at least 25 bps not topping 50% until the June meeting. The European Central Bank is expected to cut rates next week to 2.50%, according to all 82 economists polled by Reuters who expected two further cuts by mid-year. The Japanese yen weakened 0.52% against the greenback to 149.85 per dollar. Bank of Japan Governor Kazuo Ueda told reporters at the close of a Group of 20 finance meeting in South Africa it was notable that many countries had warned of high global economic uncertainty.Sterling weakened 0.36% to $1.2627.In cryptocurrencies, bitcoin rose 1.02% to $85,314.69 after falling to $82,156.99 on Wednesday, its lowest since November 11.