Crypto urges Congress to change DOJ rule used against Tornado Cash devs

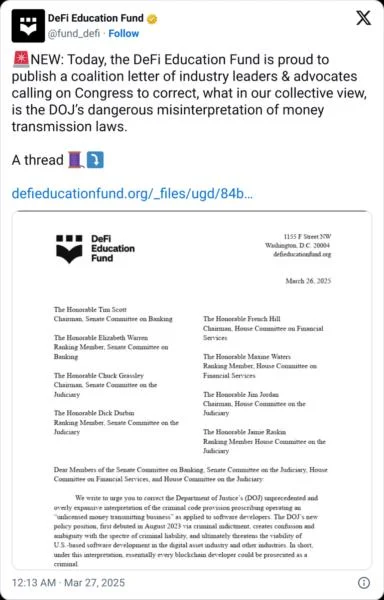

A coalition of crypto firms has urged Congress to press the Department of Justice to amend an “unprecedented and overly expansive” interpretation of laws that were used to charge the developers of the crypto mixer Tornado Cash.A March 26 letter signed by 34 crypto companies and advocate groups sent to the Senate Banking Committee, House Financial Services Committee and the House and Senate judiciary committees said the DOJ’s take on unlicensed money-transmitting business means “essentially every blockchain developer could be prosecuted as a criminal.”The letter — led by the DeFi Education Fund and signed by the likes of Kraken and Coinbase — added that the Justice Department’s interpretation “creates confusion and ambiguity” and “threatens the viability of U.S.-based software development in the digital asset industry.”The group said the DOJ debuted its position “in August 2023 via criminal indictment” — the same time it charged Tornado Cash developers Roman Storm and Roman Semenov with money laundering.Storm has been released on bail, has pleaded not guilty and wants the charges dropped. Semenov, a Russian national, is at large.The DOJ has filed similar charges against Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill, who have both pleaded not guilty.The crypto group’s letter argued that two sections of the US Code define a “money transmitting business” — Title 31 section 5330, defining who must be licensed and Title 18 section 1960, which criminalizes operating unlicensed.It added that 2019 guidance from the Treasury’s Financial Crimes Enforcement Network (FinCEN) gave examples of what money-transmitting activities and said that “if a software developer never obtains possession or control over customer funds, that developer is not operating a ‘money transmitting business.’”The letter argued that the DOJ had taken a position that the definition of a money transmitting business under section 5330 “is not relevant to determining whether someone is operating an unlicensed ‘money transmitting business’ under Section 1960” despite the “intentional similarity” in both sections and FinCEN’s guidance.The group accused the DOJ of ignoring both FinCEN’s guidance and parts of the law to pursue its own interpretation of a money-transmitting business when it charged Storm and Semenov.They said the result had seen “two separate US government agencies with conflicting interpretations of ‘money transmission’ — an unclear, unfair position for law-abiding industry participants and innovators.”The letter said that if not addressed, the Justice Department’s interpretation would expose non-custodial software developers “within the reach of the U.S. to criminal liability.”“The resulting, and very rational, fear among developers would effectively end the development of these technologies in the United States.”In January, Michael Lewellen, a fellow of the crypto advocacy group Coin Center, sued Attorney General Merrick Garland to have his planned release of non-custodial software declared legal and to block the DOJ from using money transmitting laws to prosecute him.Lewellen said the DOJ “has begun criminally prosecuting people for publishing similar cryptocurrency software,” which he claims extended the interpretation of money-transmitting laws “beyond what the Constitution allows.”