Crypto investment products log over $1B in weekly inflows, lifting total AUM to record high of $188B: CoinShares

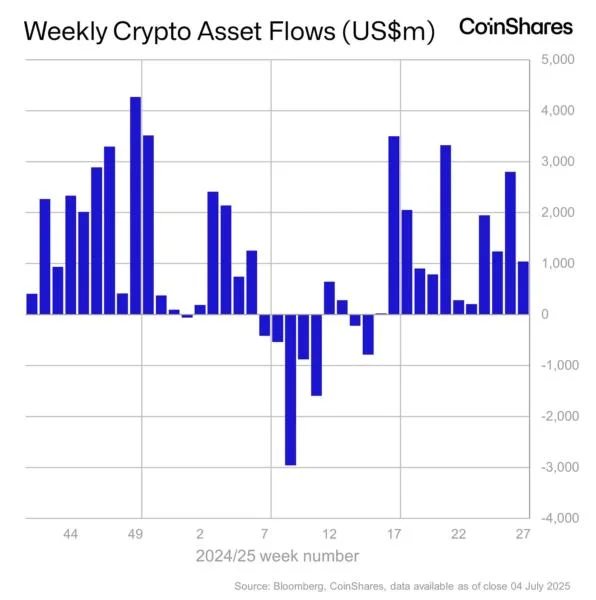

Crypto investment products pulled $1.04 billion in net inflows last week, lifting total assets under management to a record $188 billion and extending the current inflow streak to 12 weeks, CoinShares wrote in its latest report.Inflows since the run began in April now total $18 billion, while weekly trading volumes held at $16.3 billion, in line with the 2025 average.Weekly crypto asset flows. Images: CoinShares.The US still commands the bidThe United States continued to dominate investor appetite, accounting for $1 billion of last week’s inflows. Funds issued by BlackRock, Fidelity, and ARK 21Shares led the U.S. spot BTC exchange-traded fund complex, The Block’s data dashboard shows.Germany and Switzerland followed with $38.5 million and $33.7 million, respectively. Sentiment remained negative in Canada and Brazil, which logged outflows of $29.3 million and $9.7 million, respectively.Bitcoin products recorded a fourth consecutive week of positive flows, attracting $790 million. However, the figure was down from the previous three-week average of $1.5 billion, which could be a sign of cooling demand as BTC ticked toward a fresh peak, according to CoinShares Head of Research James Butterfill, noted on Monday. “The moderation in inflows suggests that investors are becoming more cautious as Bitcoin approaches its all-time high price levels,” he stated.Meanwhile, Ether notched a proportional outperformance relative to Bitcoin, Butter said. Ethereum-based funds saw their 11th consecutive week of inflows, adding $226 million. Over that stretch, weekly inflows have averaged 1.6% of assets under management, double Bitcoin’s 0.8%.This likely indicates a steady shift toward the second-largest crypto asset, according to CoinShares’ Head of Research. Among smaller assets, Solana and XRP registered minor inflows, while multi-asset funds posted modest outflows.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.