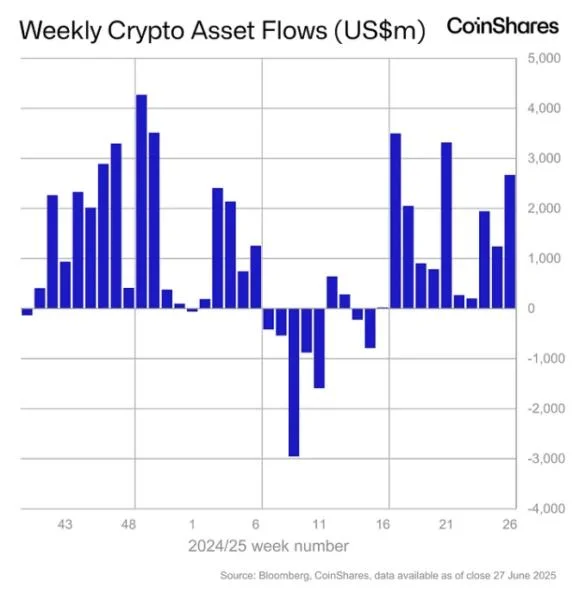

Crypto investment products attract another $2.7 billion as inflow streak extends to 11 weeks: CoinShares

Crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded another $2.7 billion in net inflows globally last week, according to CoinShares data.It marks the eleventh consecutive week of net inflows for global crypto funds, totaling $16.9 billion. It also brings year-to-date inflows to a new high of $17.8 billion at the halfway mark, CoinShares Head of Research James Butterfill said in a Monday report — tracking similarly to the $18.3 billion generated in H1, 2024 when the U.S. spot Bitcoin exchange-traded funds launched. The global crypto funds now have a combined $184.4 billion in assets under management."We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy," Butterfill said.Weekly crypto asset flows. Images: CoinShares.Bitcoin and the US dominateBitcoin-based funds notched up their third consecutive positive week, accounting for 83% of the net inflows, adding $2.2 billion. In contrast, short-Bitcoin investment products registered a further $2.9 million in net outflows, bringing year-to-date outflows to $12 million — a clear indication of broadly positive sentiment towards bitcoin this year, Butterfill wrote.The U.S. spot Bitcoin ETFs accounted for the majority of that figure, attracting $2.2 billion last week, according to data compiled by The Block.Meanwhile, Ethereum-based funds added another $429 million, marking their tenth consecutive week of inflows — the longest streak of inflows since mid-2021 — and bringing their year-to-date figures to $2.9 billion.However, the U.S. spot Ethereum ETFs were less dominant than their Bitcoin counterparts, accounting for $283.5 million of last week's global Ethereum fund inflows.Overall, the U.S. led regionally with net inflows of $2.7 billion, followed by Switzerland and Germany, with crypto investment products of $23 million and $19.8 million, respectively. This was offset by outflows of $13.6 million, $2.4 million, and $2.3 million from funds in Canada, Brazil, and Hong Kong.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.