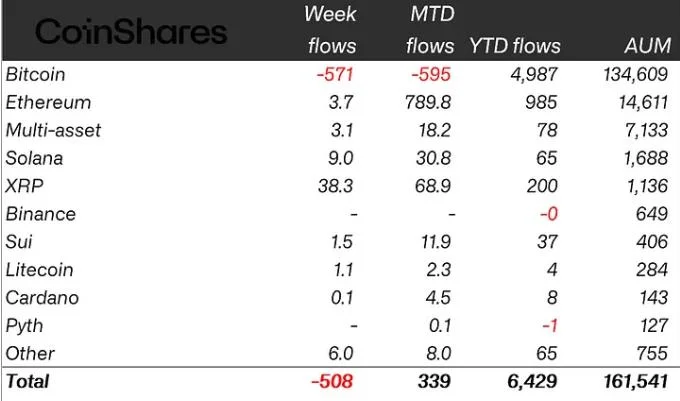

Crypto ETPs see $508M outflow as Bitcoin sell-off continues — CoinShares

Cryptocurrency exchange-traded products (ETPs) recorded significant outflows last week, continuing a trend of investor pullback, according to digital asset investment firm CoinShares.Crypto ETPs saw outflows of $508 million in the past trading week, following $415 million in outflows the previous week, CoinShares reported on Feb. 24.The spike of selling pressure in the crypto ETP sector came as investors exercised caution following the US presidential inauguration and subsequent market uncertainty around trade tariffs, inflation and monetary policy, CoinShares research head James Butterfill said.Bitcoin (BTC) ETPs — the largest crypto asset by market cap — again suffered the biggest losses, while XRP (XRP) investment products saw another week of major inflows.Crypto ETP outflows were exclusive to Bitcoin last weekBitcoin investment products suffered the most losses last week, accounting for $571 million in outflows.In contrast, altcoin ETPs recorded either some inflows or zero outflows, with XRP ETPs leading buying with $38 million of inflows.XRP ETPs have seen $819 million of inflows since November 2024, which reflects investor hopes that the US Securities and Exchange Commission will drop its Ripple lawsuit and approve a spot XRP ETF.Solana (SOL), Ether (ETH) and Sui (SUI) followed with inflows of $8.9 million, $3.7 million and $1.5 million, respectively.BlackRock’s iShares ETFs hit with $22 million lossesThe past trading week marked a rare event of BlackRock’s iShares exchange-traded funds (ETF) seeing losses of $22 million.ProShares ETFs were among the only major US ETPs that did not post losses last week, seeing $38 million of inflows, according to CoinShares.On the other hand, crypto ETPs by Grayscale Investments and Fidelity Digital Assets saw the largest outflows, amounting to $170 million and $166 million, respectively.Regionally, the majority of crypto ETP trading again came from the US, which saw $560 million in outflows. The negative trend was not reflected in Europe, which continued to see steady inflows, with Germany and Switzerland leading inflows with $30.5 million and $15.8 million, respectively.