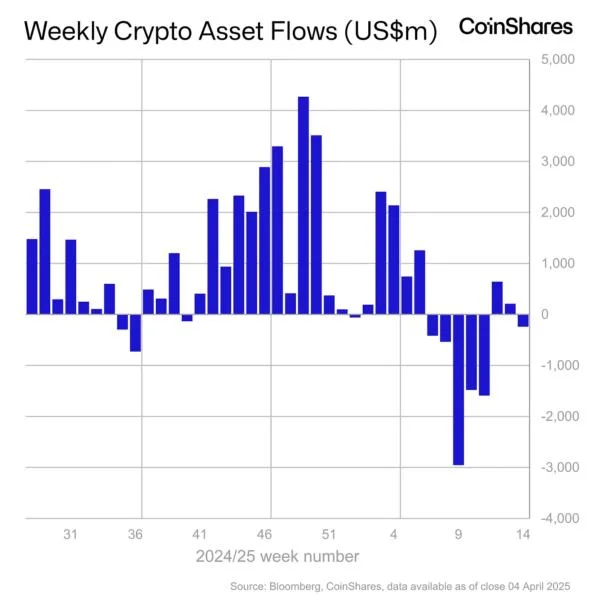

Crypto equities see modest interest amid $240 million in ‘minor outflows’ from global digital asset funds: CoinShares

Investors pulled a net $240 million from global crypto funds issued by wealth managers like Bitwise, BlackRock and Grayscale last week as U.S. commerce tariffs unsettled financial markets, according to CoinShares Head of Research James Butterfill.Bitcoin products led the capital exit, with $207 million in outflows, shaving year-to-date inflows down to $1.3 billion. Yet, total assets under management recorded a small increase, Butterfill wrote in a weekly report.“Despite this, total assets under management remained remarkably stable at $132.6bn, marking a 0.8% increase over the week,” Butterfield said. “This resilience is especially notable compared to other asset classes, such as MSCI World equities, which saw an 8.5% decline over the same period, underscoring the robustness of digital assets amid economic uncertainty.”CoinSharesWeekly crypto asset flows. Images: CoinSharesLast week’s crypto fund flows mirrored trading in digital asset markets, which witnessed a broad sell-off as President Donald Trump issued large-scale tariffs on multiple U.S. trade partners. Per The Block’s price page, Bitcoin fell over 6% in the past week as tariff scares gripped the cryptocurrency market.Net outflows between March 31 and April 4 also erased $226 million in net inflows from the previous week. The movements showed “normal market dynamics rather than fundamental weaknesses in crypto,” Marcin Kazmierczak, co-founder and COO of RedStone, told The Block. “The relatively modest outflows despite the tariff situation actually demonstrate resilience. Our crypto industry is fundamentally stronger now than during previous downturns, with institutional infrastructure and real-world applications continuing to advance."US Bitcoin funds dominate regional exits as crypto equities capture two-week buying streakThe U.S. led regional weekly capital outflows yet again, but last week showed a broader investor sentiment. This time, the U.S. and Germany noted the largest outflows, coming in at $210 million and $17.7 million, respectively. Switzerland and Sweden also noted institutional withdrawals. In Canada and Brazil, a “buy the dip” outlook prevailed as $4.8 million and $1.4 million in new cash flowed into funds. Digital asset investment vehicles in Hong Kong and Australia attracted small inflows as well.U.S.-based bitcoin funds experienced the largest drawdown, with funds issued by Grayscale, BlackRock and Bitwise seeing the biggest selloffs.While some altcoin-focused funds saw a minor capital influx, investors trimmed positions tied to leaders like Ethereum, Solana and Sui. “Flows in altcoins were very mixed, with Ethereum seeing US$37.7m outflows, as did Solana and Sui, with outflows of US$1.8m and US$4.7m, respectively. More esoteric tokens, such Toncoin, saw inflows of US$1.1m," per Butterfill.Despite the downbeat market sentiment and the worst trading quarter since FTX’s crash, blockchain-related stocks notched a second consecutive week of inflows. CoinShares reported $8 million in total inflows to crypto equities for the second successive week. “Though crypto equities like Coinbase faced challenges last quarter, the recent inflows into blockchain equities highlight that savvy investors recognize buying opportunities during market dips. What we’re experiencing is primarily a macro market shakeout driven by tariff concerns and global economic uncertainty, not a crypto-specific problem,” Kazmierczak remarked.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.