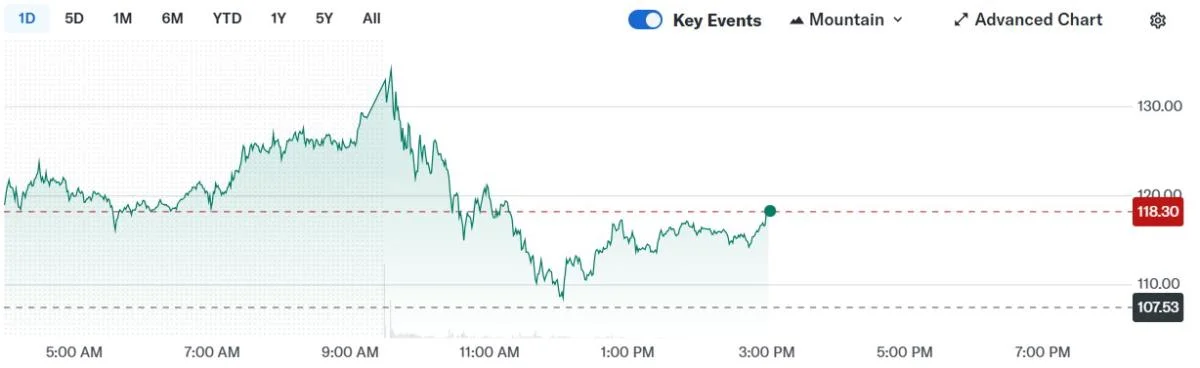

Circle Shares Extend Rally, Gain 15% on Monday to Hit $134 After Strong IPO

Circle’s Wall Street debut has ignited investor frenzy, with its stock exploding past $138 just days after going public. The rally follows a mix of strategic moves and heavy interest from major players like ARK Invest and Japan’s SBI Group, highlighting surging global appetite for the stablecoin issuer.Circle (CRCL), the company behind USD Coin (USDC), saw its shares skyrocket from its IPO price of $31 to an intraday high of $138.57 on Monday, though it later pared back gains. On its first trading day, the stock opened at $69 and closed at $83.23, marking a 169% jump from the IPO price. Source: Yahoo FinanceSBI's $50 Million Bet on CircleMuch of the renewed interest stems from a strategic $50 million investment by SBI Holdings and SBI Shinsei Bank. SBI, a long-standing partner of Ripple, is facilitating Circle’s expansion into Japan through SBI VC Trade. The move grants Circle a direct channel into the tightly regulated and lucrative Japanese crypto market. The partnership may help USDC carve out a firmer position in Asia’s stablecoin ecosystem, which has so far been dominated by Tether (USDT).I am incredibly proud and thrilled to share that is now a public company listed on the New York Stock Exchange under !12 years ago we set out to build a company that could help remake the global economic system by re-imagining and re-building it from the ground up… Adding to the momentum, Cathie Wood’s ARK Invest made headlines by acquiring nearly 4.5 million Circle shares on the first day of trading. The purchase, worth $373 million at closing prices, reflects ARK’s growing interest in companies tied to blockchain infrastructure. The firm already holds major positions in Coinbase, Robinhood, and Block.Read more: Circle Shares Soar 235% on First Day of NYSE TradingInterestingly, ARK funded this aggressive Circle purchase by offloading $39 million in Coinbase shares, $18.5 million in Robinhood, and $10.4 million in Block.The NYSE welcomes in celebration of its IPO! For over a decade, Circle has connected traditional finance and digital assets, seeking to create a secure, always-on digital economy. Valuation Tied to USDC’s GrowthThe bullish sentiment around Circle appears closely tied to USDC's rising role in global finance. With Circle's market cap now accounting for half of all circulating USDC, investors are clearly betting on the stablecoin’s expansion. With backers like SBI and ARK, the company is now well-positioned to test the limits of stablecoin adoption in both traditional and crypto-native markets.