Can artificial intelligence prevent the next financial crisis?

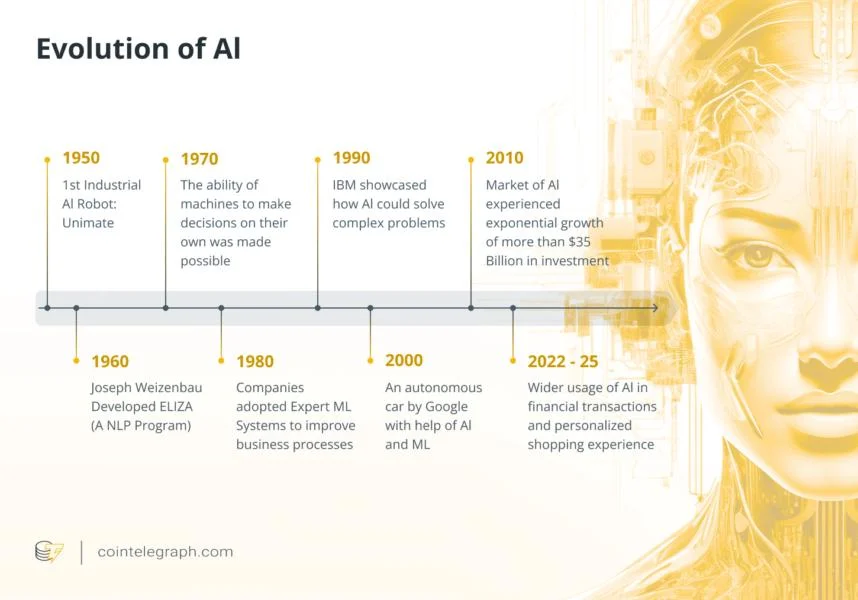

The significance of AI Artificial intelligence plays a big role in modern crisis prevention across various industries.In healthcare, AI assists with early cancer detection and disease diagnosis.In transportation, AI powers autonomous vehicles, where real-time analysis of sensor data enables cars to avoid collisions, ensuring passenger safety.Even in customer service, AI-driven chatbots outperform humans in recognizing frustration and de-escalating situations, offering smoother, more efficient support.So, given AI’s growing track record of preventing crises, what else can it predict or prevent?AI has already embedded itself in financial markets, with AI agents conducting high-frequency trading and risk management models monitoring investments. However, despite its success in preventing crashes — both literal and metaphorical — AI has not yet been able to prevent full-scale financial crises.Let’s dig deeper. The evolution of AI in economic forecasting AI isn’t new. In the 1980s, pioneering economists began exploring the application of AI in economic research.Notably, Nobel laureate Lawrence R. Klein, renowned for his work in macro-econometric modeling, ventured into nowcasting and real-time forecasting during the last three decades of his career. His efforts laid the groundwork for integrating AI into economic analysis.The early 2000s witnessed further advancements as AI systems became more adept at forecasting economic trends.Researchers developed models that could process and analyze economic data more efficiently, leading to improved predictive capabilities. These developments weren’t enough to predict the financial crisis of 2008, however.In recent years, the rise of machine learning models has revolutionized economic forecasting. These models can analyze vast and complex data sets, identifying patterns and trends that were previously undetectable.Let’s move on to how they work. AI algorithms for economic forecasting The primary AI methodologies utilized in this domain include machine learning and deep learning models.Machine learning modelsIn economic forecasting, both supervised and unsupervised learning techniques are applied to identify patterns and make predictions.Supervised learning: This approach involves training models on labeled data sets, where the outcome is known. For instance, supervised learning algorithms can predict economic indicators such as gross domestic product (GDP) growth, inflation rates and unemployment trends by analyzing historical data. Models like linear regression, support vector machines and decision trees are commonly used for these purposes.Unsupervised learning: In contrast, unsupervised learning deals with unlabeled data, seeking to uncover hidden patterns or groupings. Clustering algorithms, for example, can segment economies or markets into distinct groups based on similarities in economic indicators, aiding in targeted policy formulation and investment strategies.Deep learningDeep learning in economic forecasting has shown promising results.Deep neural networks, particularly architectures like long short-term memory (LSTM) networks and convolutional neural networks (CNNs), are adept at processing sequential and spatial data, respectively. These models can capture intricate patterns in economic indicators, leading to improved predictive performance.A study on macroeconomic forecasting using deep learning techniques found that these models provided more accurate predictions for variables such as GDP growth and inflation rates compared to conventional methods.Whether current AI algorithms for economic forecasting can be relied on for the prediction of financial crises, however, is another question entirely.Did you know? Deep learning is a specialized subset of machine learning that utilizes multi-layered neural networks to automatically learn and extract complex patterns from large data sets. Is AI capable of predicting economic downturns? AI currently boasts methodologies to detect early signs of financial distress and forecast potential recessions.AI-driven early warning systems (EWS) have been developed to monitor and analyze vast amounts of financial data, enabling the detection of anomalies and patterns indicative of impending economic challenges.These systems utilize machine learning algorithms to assess various indicators, such as market trends, credit spreads and macroeconomic variables, providing timely alerts to policymakers and financial institutions.For instance, the International Monetary Fund (IMF) has explored machine learning models tailored to predict crises affecting different sectors of the economy, including financial, fiscal and external sector crises. These models incorporate extensive sets of predictors, comprising economic, financial, demographic and institutional variables to enhance predictive accuracy.Moreover, predictive analytics have been implemented to forecast potential recessions.By analyzing historical data and employing various machine learning models, researchers have developed methods to predict the probability of a recession for economies such as that of the United States.These models consider a range of macroeconomic indicators to assess the likelihood of an economic downturn in the forthcoming periods.A couple of instances of note demonstrate the current efficacy of such models:Banking sector surveillance: The European Banking Authority (EBA) has explored the potential of using advanced techniques like random forests and neural networks to automate bank supervision. By monitoring data instead of relying on manual supervisory returns, these AI-driven models aim to enhance the detection of breaches in supervisory concern levels, thereby providing early warnings of potential financial distress within banks.Stock market crisis forecasting: Research has been conducted using machine learning methods to forecast stock market crisis events. These models analyze daily financial market data and consider numerous explanatory variables to provide early warnings of stock market crises.Did you know? Financial crises are deeply complex, often involving unpredictable variables like political shifts, investor sentiment and global market interdependencies. AI for systemic risk detection By leveraging advanced algorithms and data analysis techniques, AI enhances the ability to monitor complex financial networks and assess the resilience of the institutions themselves under various scenarios.Identifying systemic risksAI applications in systemic risk detection involve continuous monitoring and assessment of the financial system to identify potential threats. Machine learning algorithms analyze vast data sets, including transaction records, market movements and economic indicators, to detect anomalies and emerging risks. This proactive approach enables early identification of vulnerabilities that could lead to financial instability.Network analysis is a key AI technique used to understand the interconnections among financial institutions. By mapping and analyzing these relationships, AI can identify critical nodes whose failure could trigger widespread systemic issues. Stress testing and scenario analysisAI enhances stress testing by automating scenario generation, allowing financial institutions to respond quickly to emerging risks. By simulating various economic scenarios, AI models can assess the resilience of financial institutions under adverse conditions, providing insights into potential vulnerabilities.AI models can process large volumes of data and consider a wide range of variables, resulting in more accurate assessments of how institutions would perform under different stress scenarios. This capability allows for better preparation and risk management strategies to mitigate potential impacts. Challenges and limitations of AI in economic forecasting While artificial intelligence offers significant advancements in economic forecasting and financial analysis, challenges and limitations remain.The greatest challenge for AI when preventing financial crises stems from the fact that financial markets are influenced by a multitude of factors, including human behavior, geopolitical events and unforeseen shocks, which can be challenging for AI models to account for comprehensively.Moreover, the reliance on historical data may limit the models’ ability to predict unprecedented events.Aside from this, there are general AI-based concerns to take into account:Data quality and availabilityThe effectiveness of AI models heavily depends on the quality and completeness of the data they are trained on. Inaccurate, inconsistent or incomplete data can lead to unreliable predictions, potentially exacerbating financial instability.Additionally, accessing real-time data poses challenges, as delays or inaccuracies in data collection can hinder timely analysis and decision-making. For instance, the limited availability of relevant historical data can impede AI models’ ability to generate reliable forecasts for rare or unprecedented economic events.Model interpretabilityMany AI models, particularly deep learning algorithms, operate as “black boxes,” making it difficult for users to understand the decision-making processes behind their outputs.This lack of transparency raises concerns in the financial sector, where explainability is crucial for trust and regulatory compliance.The complexity of these models can obscure the reasoning behind specific predictions, complicating the validation and acceptance of AI-driven insights. Efforts to develop explainable AI methods are ongoing, aiming to bridge the gap between model complexity and user interpretability.For example, there’s the Local Interpretable Model-Agnostic Explanations (LIME) method. LIME aims to clarify the predictions of complex, black-box models by approximating them locally with simpler, interpretable models. This approach helps users understand the reasoning behind individual predictions.Ethical and regulatory considerationsAI systems can inadvertently perpetuate or amplify biases present in their training data, leading to unfair or discriminatory outcomes in financial decision-making. Addressing algorithmic bias is essential to prevent systemic inequalities.Moreover, the rapid integration of AI into finance presents regulatory challenges, as existing frameworks may not adequately address the unique risks associated with AI applications.Regulators must balance fostering innovation with ensuring that AI systems operate fairly and transparently.Did you know? Eliezer Yudkowsky once remarked, “By far, the greatest danger of artificial intelligence is that people conclude too early that they understand it.” Can AI predict financial crises? The bottom line is, currently, AI cannot fully prevent financial crises. While AI systems have advanced in detecting early warning signs and assessing risks, they are not infallible and can sometimes exacerbate systemic risks. For instance, AI-driven trading algorithms can contribute to market volatility if not properly regulated. Moreover, AI models are only as good as the data they are trained on; biases or inaccuracies in data can lead to flawed predictions. Therefore, while AI can aid in mitigating certain aspects of financial instability, it is not a standalone solution for preventing financial crises.However, current initiatives are focused on enhancing AI capabilities in financial crisis prediction. Collaborations between academic institutions, industry and government agencies aim to advance AI research in economics. For instance, projects like the AI Economist utilize reinforcement learning to design optimal economic policies that balance efficiency and equity. Additionally, central banks and financial regulators are exploring AI tools to improve stress testing and risk assessment frameworks. These efforts are geared toward creating more resilient financial systems capable of anticipating and mitigating potential crises.