Blockstream to launch Bitcoin lending funds with multi-billion investment

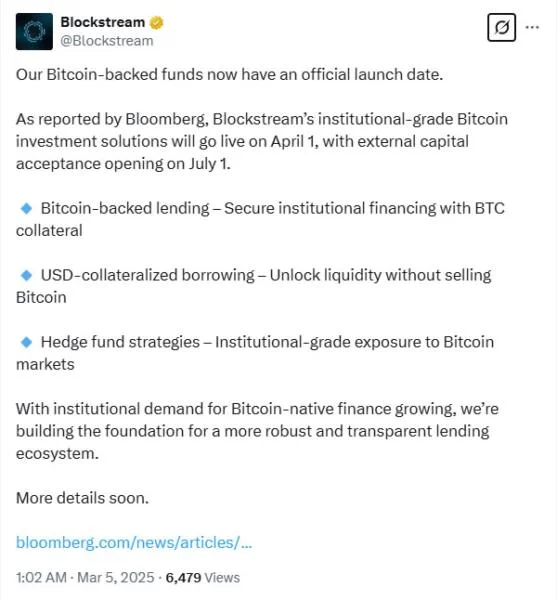

Bitcoin developer Blockstream has secured a multibillion-dollar investment to launch three new institutional funds, including two that will enable lending Bitcoin.“Blockstream’s institutional-grade Bitcoin investment solutions will go live on April 1, with external capital acceptance opening on July 1,” the firm stated on X on March 4, confirming an earlier Bloomberg report.It added that the investment products will offer Bitcoin-backed lending and secure institutional financing with Bitcoin collateral, USD-collateralized borrowing enabling investors to unlock liquidity without selling Bitcoin, and hedge fund strategies offering institutional-grade exposure to Bitcoin markets.Blockstream debuted its new asset management business in January, unveiling the Blockstream Income Fund and the Blockstream Alpha Fund.The Income Fund is focused on loans between $100,000 and $5 million, while the Alpha Fund focuses on portfolio growth, providing investors with exposure to “infrastructure-based revenue streams like Lightning Network node operations.” Blockstream, which offers products such as the Liquid Network — a Bitcoin sidechain launched in 2018 to provide faster transactions — secured $210 million in financing through convertible notes in October. Blockstream joins companies like Grayscale, Pantera, Galaxy Digital, and Crypto.com in offering crypto-focused investment funds with various levels of exposure to the industry.Blockstream CEO and Bitcoin pioneer Adam Back was among many industry leaders who derided President Donald Trump’s plans for a strategic crypto reserve because it would include cryptocurrencies besides Bitcoin.Donald Trump announced the strategic crypto reserve on March 2, stating that it would include Bitcoin and Ether . However, he sparked a wave of criticism for including XRP , Solana , and Cardano (ADA) in the reserve.