BlackRock Bitcoin ETF surpasses 50% market share despite 3-day sell-off

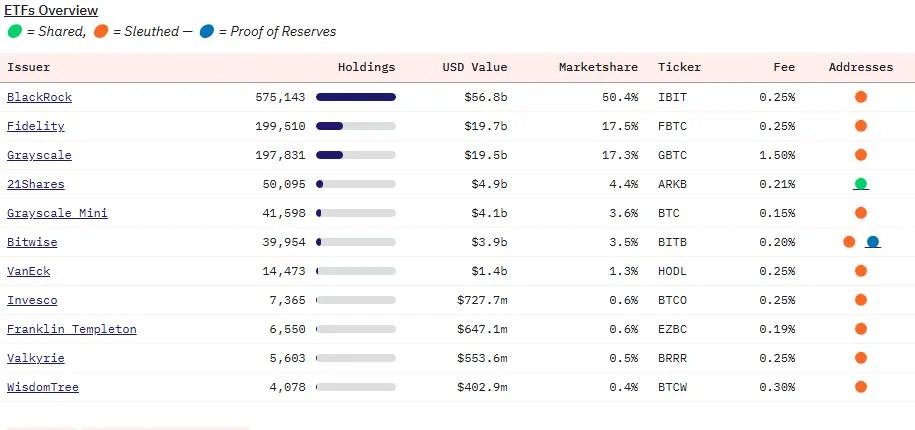

The market share of BlackRock’s Bitcoin exchange-traded fund (ETF) has grown to over 50%, even as Bitcoin ETF issuers experience a broader sell-off.BlackRock, the world’s largest asset manager, now holds over $56.8 billion worth of Bitcoin , accounting for 50.4% of the holdings of all US ETF issuers, which collectively manage over $112 billion, according to Dune data.The milestone comes more than a year after the US spot Bitcoin ETFs first debuted for trading on Jan. 11, 2024.However, Bitcoin ETFs have been on a recent three-day selling streak, recording over $364 million worth of cumulative net outflows on Feb. 20, of which BlackRock’s iShares Bitcoin Trust ETF (IBIT) accounted for $112 million, Farside Investors data shows.ETF investments played a major role in Bitcoin’s 2024 rally, contributing approximately 75% of new investment as Bitcoin recaptured the $50,000 mark on Feb. 15.Bitcoin price withstands ETF outflowsBitcoin staged a recovery above $99,300 on Feb. 21 but remains down nearly 3% on the monthly chart.Despite increasing ETF outflows, Bitcoin’s price has remained resilient, suggesting that ETFs are not the primary driver of market movements, according to Marcin Kazmierczak, co-founder and chief operating officer of RedStone. Kazmierczak told Cointelegraph:“This indicates that other forces — such as broader market liquidity, institutional accumulation, or macroeconomic trends — are also at play.”Still, some industry leaders are concerned about Bitcoin’s price action, which has been range-bound for over two months.Bitcoin’s price action may be manufactured, based on the trajectory of the past months, according to Samson Mow, CEO of Jan3 and founder of Pixelmatic.“It seems like it’s some sort of price suppression,” said Mow during a panel discussion at Consensus Hong Kong 2025, adding:“If you look at the price movement, we peak, and then we stay steady and chop sideways. And it’s good, you can say it’s consolidation, but it just looks very manufactured.”“The very tight range in which you’re trading just doesn’t look natural at all,” Mow added.Magazine: BTC above $150K is ‘speculative fever,’ SAB 121 canceled, and more: Hodlers Digest, Jan. 19 – 25