BlackRock Bitcoin ETF Makes Big Move to Propel Investment

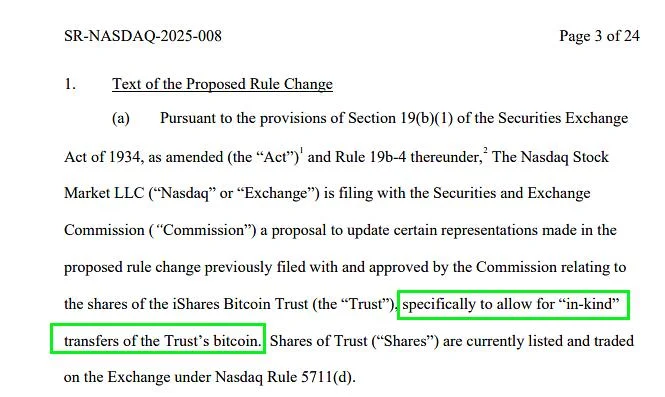

Nasdaq has proposed a rule change to the SEC to allow in-kind creation and redemption for the BlackRock iShares Bitcoin Trust (IBIT). This adjustment would let authorized participants (APs) use Bitcoin or cash to create or redeem fund shares.In-kind processes, where APs directly transact in Bitcoin, enhance efficiency, enabling APs to swiftly respond to ETF demand without involving cash. Retail investors remain excluded from these activities.James Seyffart/X">Initially, the SEC approved spot Bitcoin ETFs like IBIT with cash-only redemption, but this proposed change reflects a move toward greater integration of Bitcoin in institutional ETF operations.Bitcoin ETFs record massive inflowsOn Jan. 24, 2025, the Bitcoin ETF market recorded a significant net flow of $517.7 million, according to Farside Investors. Key inflows included $186.1 million into FBTC, $168.7 million into ARKB and $155.7 million into IBIT. In contrast, BITB saw an outflow of $8.6 million.Other ETFs such as BTCO, EZBC, BRRR, HODL and GBTC exhibited minimal activity, with BTCW registering a modest inflow of $2.8 million.In addition, large investors have been driving Bitcoin price gains since the U.S. election, with their holdings increasing from 16.2 million to 16.4 million BTC, according to data from CryptoQuant.CryptoQuant">In contrast, small investors reduced their holdings from 1.75 million to 1.69 million BTC during the same period.