Bitcoin's new record lifts industry stocks ahead of 'Crypto Week' in Washington

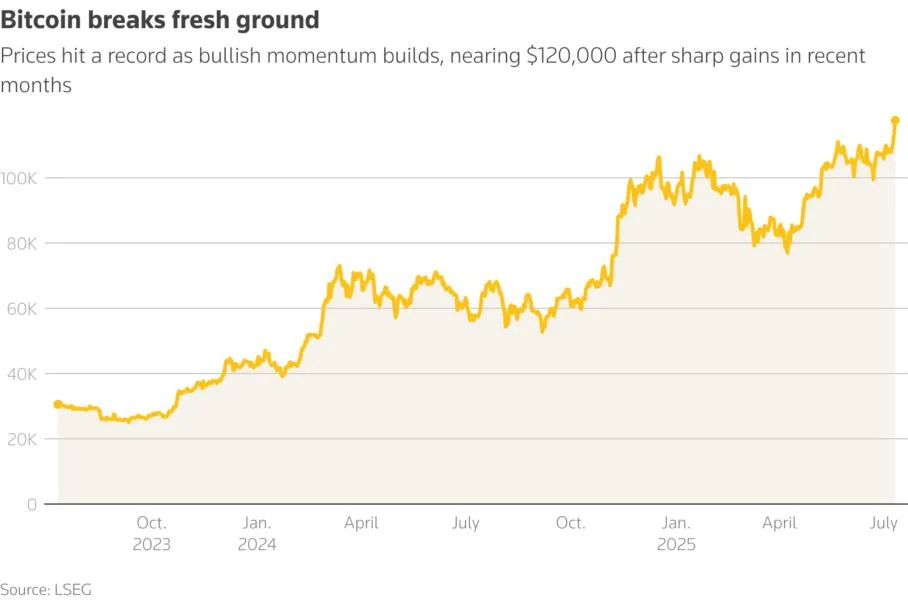

U.S.-listed crypto stocks jumped on Friday as bitcoin surged to a record high in the run-up to a landmark week that could cement policy wins for the crypto industry.Starting July 14, the House of Representatives will debate three major crypto bills that are likely to provide the industry the regulatory framework in the U.S. that it has long demanded.The lawmakers will discuss the Genius Act, the Clarity Act and the Anti-CBDC Surveillance State Act during the "Crypto Week", amid growing bets that the industry's strained ties with Washington is beginning to thaw.This is a sharp reversal of fortune for a sector that had once threatened to flee offshore, citing a hostile environment and heavy-handed enforcement in the U.S."We expect capital that was previously sidelined due to regulatory uncertainty to re-enter," said Jag Kooner, head of derivatives at crypto exchange Bitfinex."Even if final passage stalls, the optics of legislative engagement are bullish."The world's largest cryptocurrency was last up 3.3% at $117,307.66, taking its gains for the year to nearly 26%. The digital asset has surged nearly 41% in the last three months. Bitcoin buyer and holder Strategy rose 2.2%, while crypto miners Riot Platforms , Hut 8 and Mara Holdings gained between 1.8% and 2.5%. "Investors are racing to take positions ahead of the extra publicity this event could attract," said Dan Coatsworth, investment analyst at AJ Bell, referring to the Crypto Week.SKEPTICS RAISE RED FLAGSWith crypto becoming more and more embedded in the traditional financial system, some analysts warned the hype may be outpacing reality, as it starts to displace gold as the preferred hedge against equities."The (regulatory) backdrop has supported prices and attention has turned to bitcoin's role in portfolios, with some likening the crypto-asset to 'digital gold'. This moniker is likely premature," said Dirk Willer, Citi's global head of macro, asset allocation and emerging market strategy.With likely volatility ahead, some analysts have also cautioned investors to pause and weigh their time horizons before jumping in."It's hard not to be optimistic about bitcoin at this moment in time, but the risk of a fall in price or short-term pullback still exists," said Simon Peters, crypto analyst at online brokerage eToro.Critics have argued that the Trump administration is conceding too much to the crypto industry."I'm concerned that what my Republican colleagues are aiming for is another industry handout that gives the crypto lobby exactly its wish list," Democratic Senator Elizabeth Warren said earlier this week.She urged Congress to bar public officials, including the President, from issuing, backing or profiting from crypto tokens.Trump has faced criticism from political rivals and ethics experts over potential for conflicts of interest regarding his family's crypto ventures.