Bitcoin will hit $1.5M by 2035, says analyst who called 2024 bounce

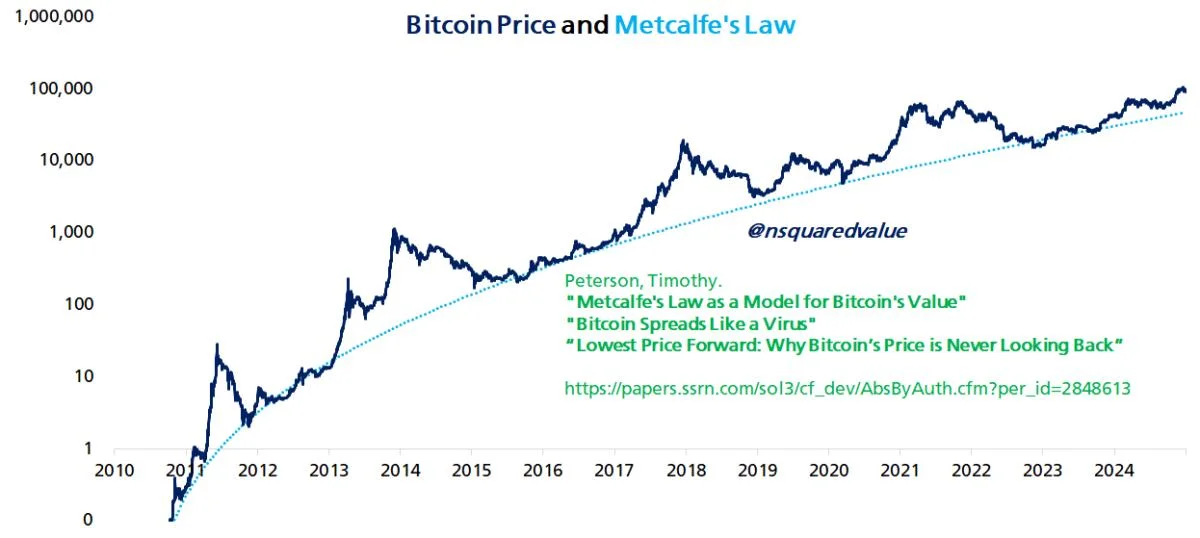

Bitcoin has a new seven-figure prediction on the horizon as one of the industry’s best-known doubles down on its bullish future.In an X post on Jan. 8, network economist Timothy Peterson, author of the popular paper “Metcalfe’s Law as a Model for Bitcoin’s Value,” announced a $1.5 million BTC price target.Peterson: Bitcoin is less than 10 years from $1.5 millionBitcoin is due to hit a giant $1.5 million per coin, and this should occur within ten years, Timothy Peterson says.Citing his own model, which puts network expansion at the heart of Bitcoin’s future value proposition, Peterson predicted that by the middle of the next decade, would be trading 15 times higher.“The year is 2035. Bitcoin is at - and you can hold me to this - $1.5 million,” he wrote in accompanying commentary. “And somewhere someone is asking ‘Is now a good time to buy Bitcoin?’”Peterson is well known as a Bitcoin bull, with his 2018 paper on Metcalfe’s Law suggesting that massive global Bitcoin propagation was only a matter of time.“Traditional currency models fail with bitcoin, but various mathematical laws which explain network connectivity offer compelling explanation of its value,” it reads.In 2020, Peterson’s Lowest Price Forward indicator correctly predicted that would never trade below $10,000 again.Last year, he timed the local BTC price bottom to within eight days when it hit in September.In a sign of his expectations for BTC price performance to come, meanwhile, another X post on Jan. 2 described ”nothing special.”“In fact, it was the second-worst ‘Up’ quarter out of the past 10,” Peterson noted.Bitcoin “isn’t done dipping”As Cointelegraph reported, BTC price predictions for the coming year are firmly mixed as the bull run that characterized much of Q4 cools.Some still see a high probability of a deeper BTC price correction, and targets extend all the way back to near old all-time highs of $73,800.By contrast, more positive takes see upside returning, with the incoming inauguration of US President-Elect Donald Trump serving as a pivotal moment.“TLDR: This dip isn’t done dipping,” Keith Alan, co-founder of trading resource Material Indicators, summarized to X followers on Jan. 9.Alan cited “suppression” of price as a short-term headwind, with buyers waiting to add exposure at lower levels than the current $92,000.“There’s no telling whether or not this move will develop into the deep correction we’ve been expecting, but as a point of reference, a move to $86.5k would represent a 20% correction from the ATH,” he wrote. “If that level doesn’t hold, then I think the CME Gap down to $77.9k could come into play.”This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.