Bitcoin retail, ETF outflows mount to $494M, analysts eye market bottom

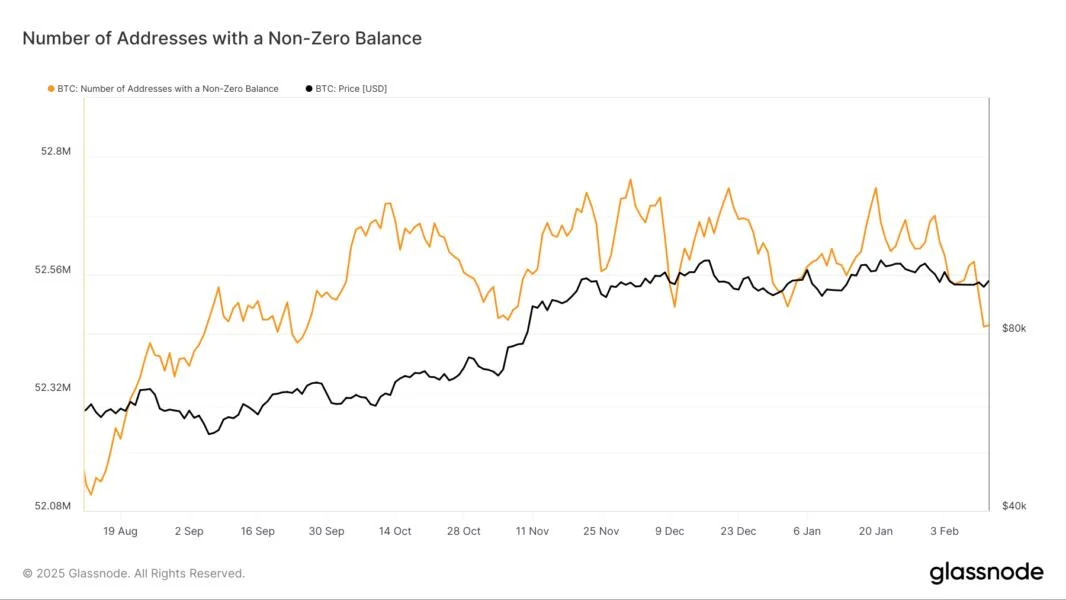

Retail investors are increasingly liquidating their Bitcoin holdings amid growing institutional outflows and geopolitical tensions worldwide.The number of Bitcoin addresses with a non-zero balance sunk below 52.45 million, which marks an over five-month low last seen in September 2024, Glassnode data shows.In comparison, the Bitcoin network boasted over 52.56 million wallets on Jan. 20, when Bitcoin reached an all-time high of $109,000, Cointelegraph Markets Pro data shows.However, most of the selling pressure stemmed from the US spot Bitcoin exchange-traded funds (ETFs).The Bitcoin ETFs recorded over $251 million worth of cumulative net outflows on Feb. 12, marking the third consecutive day of net negative outflows, amounting to a total of $494 million, Farside Investors data shows.However, some analysts believe that the crypto market is setting up for a reversal based on growing accumulation among large Bitcoin holders or whales in crypto slang.Whales accumulate near $3.8 billion dipLarge Bitcoin holders accumulated over 39,620 BTC worth over $3.79 billion in cumulative net flows within a day on Feb. 5 when Bitcoin traded below $97,600, IntoTheBlock data shows.The strong accumulation suggests that the Bitcoin bottom may be near, according to Juan Pellicer, senior research analyst at IntoTheBlock crypto intelligence platform.He told Cointelegraph:“Similar to the pattern observed in September (local price low), suggests that these large players might be seeing value at current price levels. This could indicate that the market is nearing a bottom, and the capitulation phase might be ending.”Meanwhile, crypto investor sentiment remains pressured by global trade war concerns following new import tariffs announced by the US and China. Investors still await President Donald Trump’s meeting with Chinese President Xi Jinping, aimed at resolving trade tensions.However, Bitcoin’s upside will be limited in the near term, until it performs a “decisive break” above $100,000, Iliya Kalchev, dispatch analyst at Nexo, told Cointelegraph.