Bitcoin mining difficulty sees biggest drop since 2021 China ban amid hashrate slump

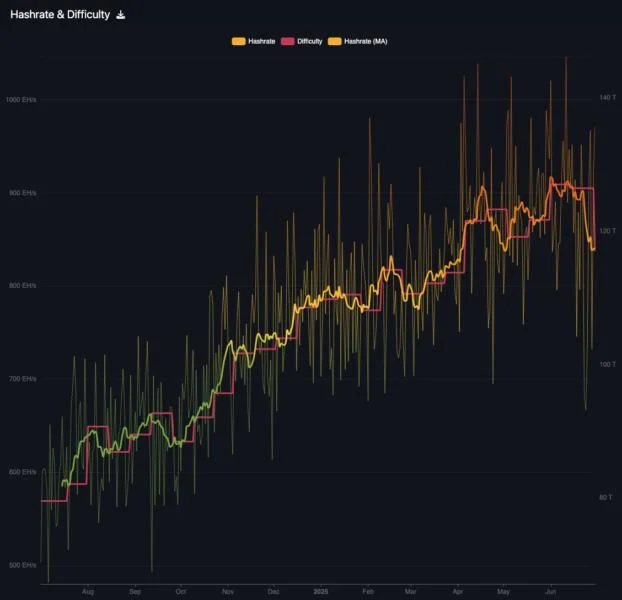

Bitcoin mining difficulty dropped around 7.5% on Sunday in the largest negative adjustment in nearly four years.The difficulty adjustment came at block height 903,168, falling to 116.96 trillion from 126.41, according to data from the Bitcoin network explorer Mempool. Bitcoin mining difficulty is not expressed in specific units. It is a relative measure of how hard it is to mine a new block compared to the easiest it could ever be. The difficulty automatically adjusts every 2016 blocks — roughly two weeks — to ensure that, on average, a new block is found every 10 minutes, regardless of how many miners are actively mining.Ahead of Sunday’s adjustment, Bitcoin’s blocks were being mined at the slower-than-average rate of one block every 10 minutes and 38 seconds, according to Clark Moody’s dashboard.The higher the difficulty, the more computational power and energy a miner needs to find the right hash for the next block. When there's an increase in the number of miners, the difficulty of mining bitcoin rises. Conversely, if there is a decrease in the number of miners competing to find new blocks, the protocol lowers the mining difficulty, making it easier for the remaining miners to discover blocks.Bitcoin difficulty and hashrate. Image: Mempool.Biggest difficulty drop since China's mining banThe difficulty decline represents the biggest drop since July 2021 during the aftermath of China's bitcoin mining ban, when it fell 28%, and bitcoin had slumped to around $34,000 from a new high above $60,000 that April. It also exceeded the 7% drop set during December 2022's bear market lows.Bitcoin is currently trading for $107,680, according to The Block's BTC price page.China imposed a sweeping ban on cryptocurrency mining in 2021, citing concerns over energy consumption, financial risk, and environmental impact. The crackdown began in May and rapidly escalated as authorities shut down mining operations across major hubs like Sichuan and Xinjiang. At the time, China accounted for over 60% of the global Bitcoin hashrate, so the move triggered a sharp drop in network activity and forced miners to relocate to countries like the United States, Kazakhstan, and Russia.The U.S. state of Texas emerged as a prominent hub, with miners arguing at the time that mining is just as good for Texas as Texas is for miners since the flexibility of the industry's electricity use can strengthen the state's power grid, curtailing demand during peaks and injecting it during troughs.Sunday's bitcoin mining difficulty drop was likely driven by such curtailment at U.S. mining sites amid early summer heatwaves, particularly in Texas, with grid operators incentivizing bitcoin miners to scale back activity in exchange for lucrative energy credits.The average total network hashrate had dropped from around 902 EH/s to 838 EH/s ahead of the difficulty adjustment, according to Mempool. However, with average block times currently running at 8 minutes and 24 seconds, a substantial upward adjustment could follow as hashrate seemingly recovers.Following the negative difficulty adjustment, hashprice jumped back toward $60 per PH/s per day ($0.05 per TH/s per day), providing temporary relief for miners left on the network now earning more for their hashrate than ahead of the drop. However, as more machines come back online, this is likely to drop again to continue its largely down-only trend.Hashprice is a term coined by bitcoin mining services firm Luxor, referring to the expected value of 1 TH/s of hashing power per day. The metric quantifies how much a miner can expect to earn from a specific quantity of hashrate.Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.