Bernstein raises target for ‘most misunderstood’ crypto firm Coinbase to $510 as shares near all-time high

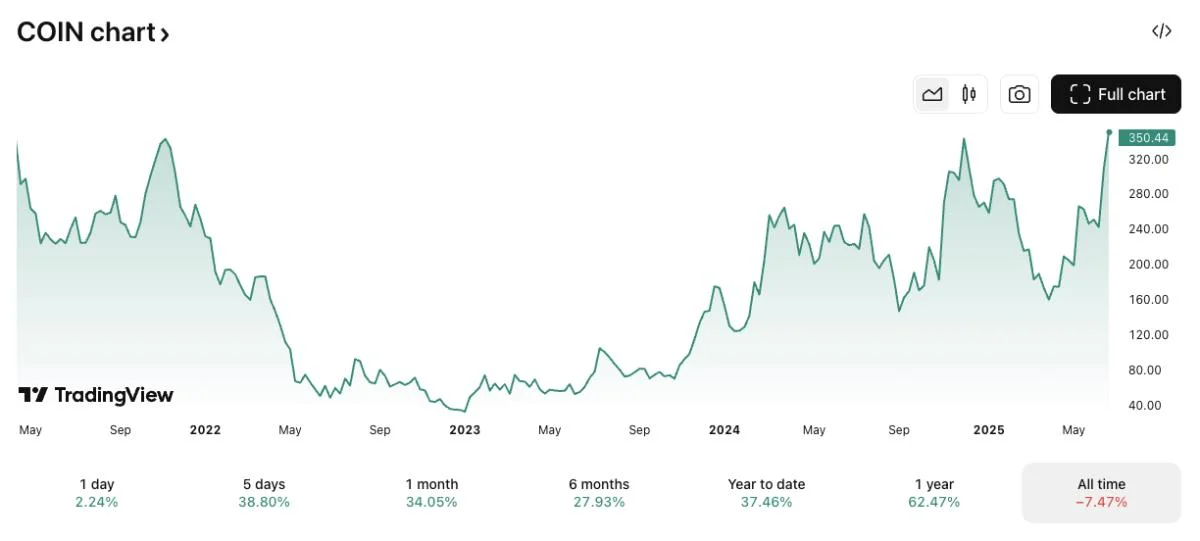

Analysts at research and brokerage firm Bernstein have raised their price target for Coinbase (ticker COIN) stock to $510 from $310, based on a combination of higher earnings projections, new growth drivers, and a revised valuation framework.Coinbase is the only crypto-native firm in the S&P 500 index but remains the "most misunderstood" company in Bernstein's crypto coverage, analysts led by Gautam Chhugani said in a Wednesday note to clients. Chhugani cited the exchange's diversified business lines, including leading U.S. crypto trading, providing custody services for most Bitcoin exchange-traded fund issuers, and incubating Base, Ethereum's fastest-growing Layer 2 and a key hub for tokenization like JPMorgan Chase's proposed JPMD coin.The firm will also be a key beneficiary of U.S. stablecoin and crypto market structure legislation, Chhugani said. Coinbase earns revenue from Circle's USDC stablecoin and recently agreed to purchase derivatives exchange Deribit, an indication it plans to expand its offerings globally. "The bear thesis on Coinbase has not played out," the analysts wrote. "Coinbase's market share has been persistent despite new competition. Coinbase's take rate has held, while competition such as Robinhood have moved up their take rate equivalent to Coinbase (for advanced traders which is the price-sensitive segment). Traditional brokerage competition is several months away from launch, which is an eternity on crypto timelines. And we believe, the traditional crypto brokerage launches are likely not even going to be full suite products, which Coinbase offers."The 'Amazon of crypto financial services'Bernstein updated its model following Coinbase's Q1 2025 results to reflect stronger growth, especially from derivatives, staking, and stablecoin-related revenue. It now forecasts 2025 revenue of $9.5 billion, including around $4.2 billion from non-trading sources. The analysts' 2026 and 2027 estimates have also been revised upward to $12.7 billion and $14.1 billion, respectively, reflecting rising income across both trading and non-trading segments.The analysts also predict Coinbase's earnings per share will rise to $17.92 in 2026 and $20.38 in 2027 as operating leverage boosts profitability. Bernstein's $510 price target for COIN stock is based on a 25x end-of-2027 P/E multiple — in line with peers, the analysts said.Coinbase's stock is currently up 3.6% in early trading on Wednesday at $356.83, according to The Block's COIN price page — nearing its all-time closing high of $357.39 — with Bernstein's target implying upside potential of more than 40% over the next 12 months.COIN/USD price chart. Image: .Gautam Chhugani maintains long positions in various cryptocurrencies. Certain affiliates of Bernstein act as market makers or liquidity providers for Coinbase stock. Bernstein has long been bullish on Coinbase, and has previously predicted COIN could see $9 billion in passive inflows as the crypto market matures. Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.