As Trump tanks Bitcoin, PMI offers a roadmap of what comes next

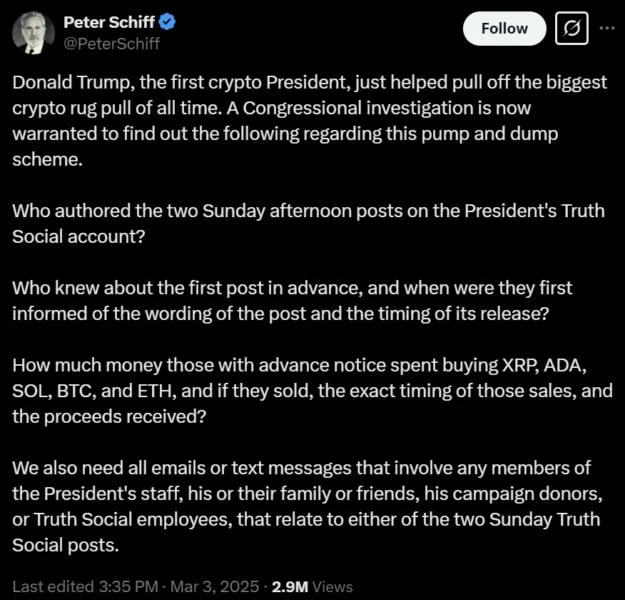

The first six weeks of US President Donald Trump’s second administration have been a wrecking ball for cryptocurrency markets. Since peaking above $109,000 on Inauguration Day, Bitcoin crashed to a low of around $78,000 in late February before swiftly rebounding to $96,000 a few days later on Trump’s crypto reserve plans. However, 24 hours later, those gains were completely reversed in a move that some have attributed to outright market manipulation. Despite the short-term volatility, Bitcoin’s trajectory moving forward can be better understood through the lens of the business cycle and global liquidity. Both variables are trekking higher as of February. What the PMI says about BitcoinFor the past seven decades, the Institute for Supply Management’s (ISM) Purchasing Managers Index (PMI) has been a valuable resource for understanding the health of the US economy. Each month, ISM releases a manufacturing and non-manufacturing PMI to gauge the health of the goods-producing and service-producing economies. Economists place more emphasis on the manufacturing PMI because it’s seen as a leading indicator of the broader economy and is more sensitive to changes in demand. The PMI data is based on quantitative and qualitative assessments of the economy through the lens of “purchasing managers,” or executives in each industry.The survey gauges their perceptions of overall business conditions, new orders, export demand, inventories, work backlogs and employment trends, which are tabulated in a single index that ranges from 0 to 100, with 50 being the cutoff point between expansion and contraction. After 26 consecutive months of contraction, ISM’s manufacturing PMI jumped above 50 in January. It remained above that critical level for a second straight month in February. Although demand remains relatively weak overall, with many panelists experiencing “the first operational shock of the new administration’s tariff policy,” the trend-change in PMI is significant within the context of the business cycle. “ISM leads the economy by about a month,” according to Real Vision founder Raoul Pal. “But it’s not just the economy — it’s every asset.”Pal’s comments are backed up by research by S&P Global Market Intelligence, which said PMI data had anticipated “every turning point in earnings over the past 14 years.”S&P Global identified a 74% correlation between its PMI-based earnings indicator and the earnings of US companies. It’s not just stocks that are strongly correlated with the PMI — it’s virtually every risk asset, including Bitcoin.“This is because strong economic growth, strong corporate earnings and low probability of recession allows investors to ‘move out along the risk curve,’” said macro analyst TomasOnMarkets.Viewing Bitcoin within the context of the PMI removes a lot of the confusion surrounding BTC’s truncated cycle in 2021, which lacked the blow-off top that many industry veterans had expected. In 2021, Bitcoin’s price basically peaked with the business cycle. With the business cycle now turning up, Pal expects Bitcoin to top in late 2025 or even early 2026. This cycle peak should coincide with the top of the ISM business cycle, which has historically been in the high 50s and low 60s. Global M2: The other Bitcoin catalystThe turning point in the business cycle is also being influenced by a rising M2 money supply, which refers to a broad measure of how much money is circulating through the economy. As Real Vision’s research has shown, it takes Bitcoin’s price about 10 weeks to reflect changes in global M2. Analyst Colin Talks Crypto has plotted 46-day and 72-day shifts in global M2 influencing Bitcoin’s price. Based on his latest revision, he gives more credence to the latter timeline. Analyst Lyn Alden has also drawn attention to the predictive power of global M2 on Bitcoin. “Bitcoin moves in the direction of global liquidity 83% of the time in any given 12-month period, which is higher than any other major asset class, making it a strong barometer of liquidity conditions,” she wrote in September. X Hall of Flame: DeFi will rise again after memecoins die down: Sasha Ivanov