Analysts Slam Pump.fun For Delaying Altcoin Season by Draining Capital

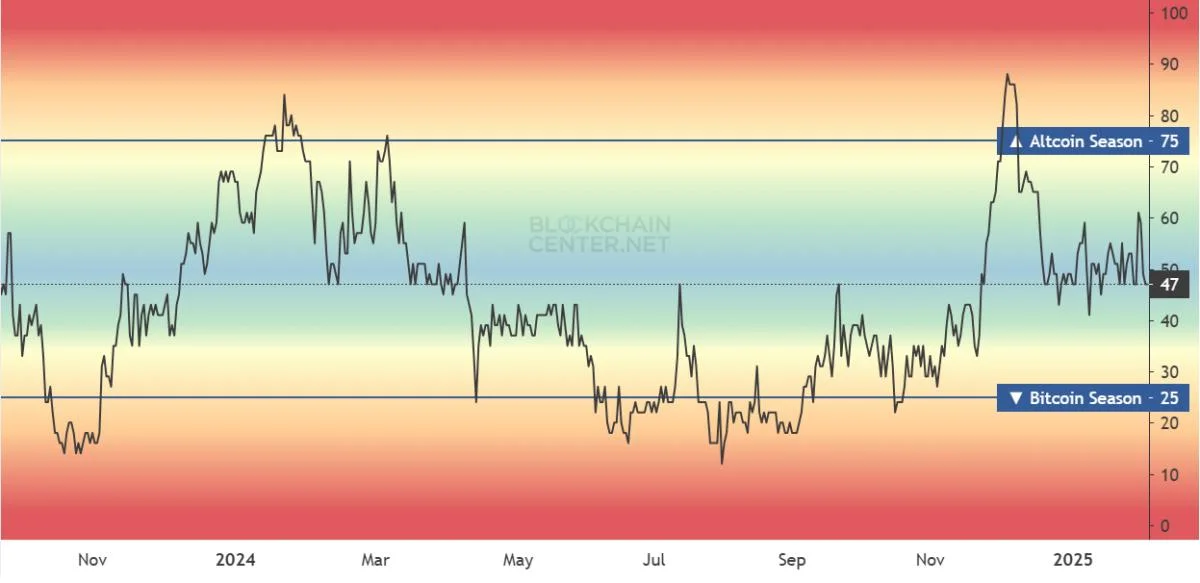

Crypto analysts are abuzz amid individual and joint attempts to dissect the impact of the Solana-based token-launching platform, Pump.fun, on the altcoin market.Analysts and traders are divided over whether the platform has single-handedly derailed the much-anticipated altcoin season by diverting liquidity away from traditional crypto assets.Analysts Make A Case Against Pump.funMiles Deutscher pointed to the Solana-based token generator as a major reason behind the delayed altcoin season. The renowned crypto analyst observes that the current market dynamic differs from previous cycles, where speculative capital flowed into altcoins with solid liquidity. “The launch of Pump Fun is directly correlated to the destruction of the altcoin market vs. BTC. The reason we’ve seen no major ‘alt season’ across majors is because the speculative capital that would’ve once poured into top 200 assets instead flooded into on-chain low caps,” Deutscher articulated. Instead, retail investors have been lured into illiquid on-chain meme coins, many of which have retraced 70-80% from their peaks. This aligns with a recent survey, which established that more than 60% of Pump.fun traders have lost money.The shift led to significant losses for latecomers, exacerbating bearish sentiment in the market and postponing the colloquial altcoin season.Historically, altcoin seasons follow Bitcoin’s price surges as capital rotates to projects with strong fundamentals. Ideally, the altcoin season was due a few months after Bitcoin’s then all-time high of $73,000 in January 2024. This was following the approval of BTC ETFs (exchange-traded funds) in the US.Master of Crypto, a veteran trader, highlighted the staggering scale of Pump.fun’s impact. He notes that since April 2024, over 5.1 million tokens have been launched on the platform. This has generated $471 million in revenue.As traders attempt to profit by chasing the platform’s products, this has created a fragmented market in which no single altcoin can gain traction.Pump.fun As A Liquidity BlackholePump.fun launched in April 2024, coinciding with the altcoin season, which contravened expected patterns. According to analysts, its meme coin mania progressively dominated speculative interest, causing traditional altcoins to struggle to attract liquidity. “Pump Fun launched in April 2024 exactly when this Altcoin run deviated from past cycles,” EllioTrades stated. Pump.fun, which allows users to launch tokens instantly with minimal effort, has surged in popularity. The platform began 2025 with a record $14 million in daily revenue. Nevertheless, critics argue that this success has been a liquidity black hole. Web3 researcher Mercek called the platform an insider-engineered liquidity heist. “Stealing liquidity from the altcoin market? Pump.fun know how to do it. Meme mania or retail gambling are terms used just to avoid seeing the hard truth…Pump fun was never about decentralization or fun… but an insider-engineered liquidity heist,” the trader explained. In their opinion, since its inception, Pump.fun has processed over $4.16 billion in transactions. It has also funneled the proceeds into centralized exchanges (CEXs), further draining the altcoin ecosystem.Counterargument To Shifting Speculative CapitalNot everyone is convinced that Pump.fun is to blame for the sluggish altcoin market. Blockchain researcher Rasrm questioned the narrative. He argues that the market cap of Pump.fun tokens are insufficient to significantly affect broader altcoin liquidity. “Total pumpfun coin MC is not nearly high enough to have affected this, surely?” he posted. Others have emphasized that speculative capital does not always stay within the ecosystem. This means that not every winning trade repositions itself on another trade. It could exit the ecosystem entirely.It appears establishing how much went into the Pump.fun’s ecosystem would be a more accurate metric.Regardless of the cause for the delayed altcoin season, Pump.fun has fundamentally altered how capital moves in the crypto market. With Solana founders reportedly disliking the platform, according to a recent survey, Pump.fun’s long-term viability remains uncertain.Meanwhile, Deutscher also associates Pump.fun’s rise to the stringent crypto regulations that have made fair project launches increasingly difficult. The US SEC’s (Securities and Exchange Commission) crackdown on CEXs and token offerings has forced market participants to explore decentralized alternatives.This regulatory playing field has created an environment where meme tokens and gambling-style speculation thrive, turning crypto into a casino. Some see this as detrimental to the industry’s long-term growth. Meanwhile, others argue it serves as a powerful onboarding tool for new users.