Analysts see boost in bitcoin with China’s new fiscal and monetary stimulus

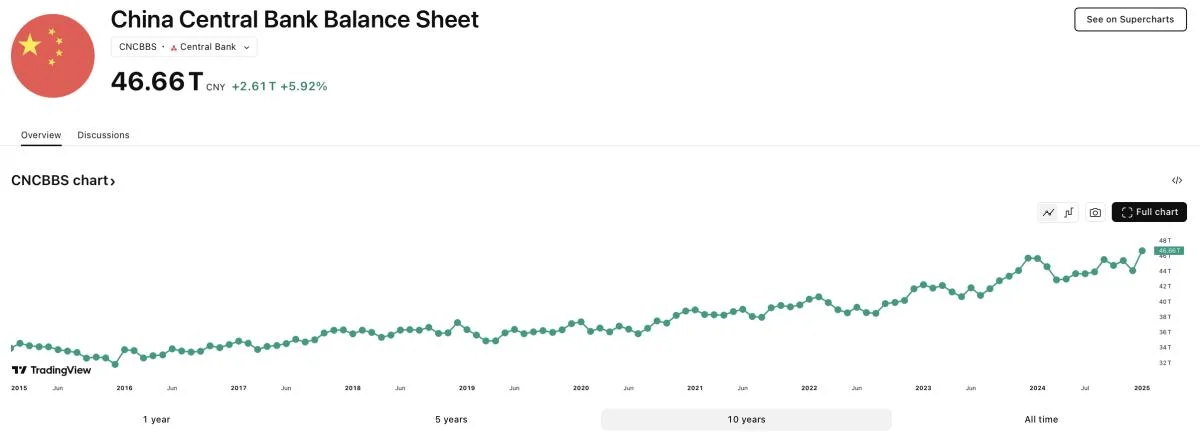

China ramped up fiscal and monetary stimulus on Wednesday, pledging increased efforts to boost consumption and mitigate the effects of an escalating trade war with the United States. Such central bank stimulus measures often lead to increased global liquidity, which can spill over into various risk assets, including bitcoin.Historically, expansive stimulus policies in major economies have coincided with bullish trends in cryptocurrency markets. A study by S&P Global found that both bullish and bearish trends in the crypto market have occurred during periods of ultra-loose monetary policy and significant tightening.In September 2024, bitcoin surged 12.3%, marking one of its best September performances. This rally aligned with China’s previous stimulus efforts, which included cutting short-term interest rates and reducing banks' reserve requirements to support its housing and equity markets. Additionally, TradingView indicates a positive correlation between bitcoin’s price and the People's Bank of China’s (PBOC) balance sheet over the past eight years.A Nexo spokesperson highlighted the potential implications of China's latest stimulus for alternative assets."In previous instances when China has ramped up monetary stimulus and injected excess liquidity into the system, in 2015 and in 2020, excess liquidity found its way into alternative assets," the spokesperson told The Block. "Such stimulus could have broader implications for global markets, increasing appetite across equities and alternative assets."However, the Nexo spokesperson also cautioned that China’s strict regulatory controls limit direct participation in crypto markets. "State-backed alternatives may absorb some of the liquidity, or capital could flow into traditional safe-haven assets like gold," they added.On Wednesday, China’s annual government work report announced a 5% GDP growth target, a fiscal deficit target of 4% of GDP, and a focus on boosting private consumption through various measures."China remains in a slow positive economic momentum, not a boom," Nansen Principal Research Analyst Aurelie Barthere told The Block. "So far, Chinese developments do not weigh as much as U.S. policy changes for crypto markets, despite positive signaling around AI investment by the central government."China braces for Trump tariff impactAccording to Reuters, Chinese Premier Li Qiang, speaking at the opening of the annual meeting of China's parliament, warned that "changes unseen in a century are unfolding across the world at a faster pace." The ongoing trade war initiated by U.S. President Donald Trump continues to threaten China’s industrial sector. This challenge is compounded by weak domestic consumption and a deteriorating, debt-laden property market, making China’s economy increasingly vulnerable.On the global growth front, analysts remain cautious in terms of risk asset appreciation."From a pure macro perspective, bitcoin's performance appears to be most dominated by global growth expectations," Bitwise European Head of Research Europe André Dragosch noted. "And those expectations have recently been repriced to the downside because of rising tariff uncertainty."Cryptocurrency and financial markets analyst Richard Ptardio also warned of potential volatility ahead."With U.S. inflation data and the Federal Reserve's interest rate decision looming, it is time to brace for further turbulence," he told The Block. "A prolonged consolidation for bitcoin might be the best we can hope for over the coming months."Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.