Analysts predict delayed altcoin season amid lack of retail traders

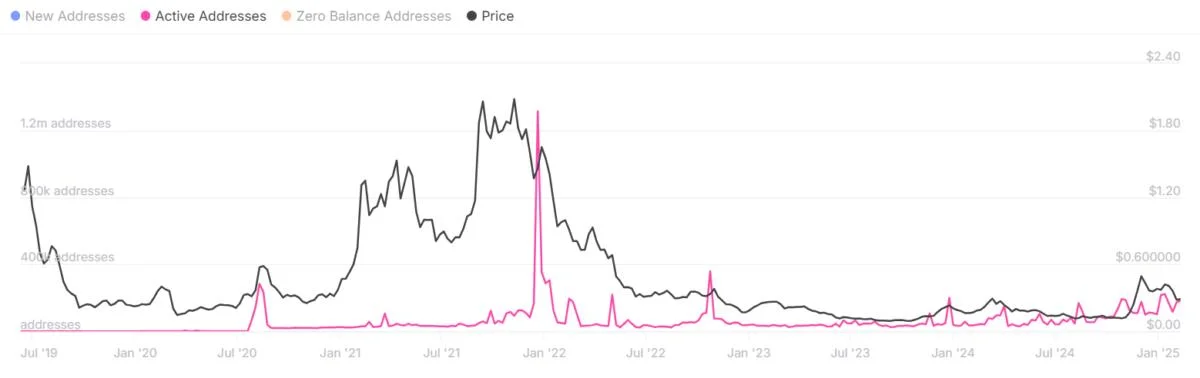

Crypto analysts suggest that the altcoin market is still in an early “speculative” phase before staging a recovery to 2021 highs.Still, some altcoins are rallying without more active participants, which may signal a decreased retail investor mindshare amid the current memecoin frenzy, resulting in a limited near-term price upside for altcoins.For instance, daily active wallets on Algorand fell to 182,170 on Feb. 10, as the Algorand token was trading at about $0.28. In contrast, the Algorand network boasted over 1.31 million active addresses when ALGO hit its all-time high of $1.46 on Dec. 20, 2021, IntoTheBlock data shows.Daily active addresses on the Chainlink network fell to 3,860 on Feb. 10, compared with 11,280 addresses on May 3, 2021, when the Chainlink token hit its $46.71 all-time high. The altcoin season has yet to come, partly because memecoins have attracted a bigger share of investor capital and mindshare during the current cycle, according to Nicolai Sondergaard, research analyst at Nansen crypto intelligence platform.The analyst told Cointelegraph:“Altcoin season will still show up, but it may not be the same way people experienced it in previous cycles. We have way more tokens now, higher levels of dispersoin, with many altcoins seeing green, but specific sectors and tokens will see higher numbers than the rest.”Despite their high-risk profile and lack of fundamental utility, memecoins continue to dominate retail speculation with their potential for quick profits.Earlier on Feb. 14, a savvy crypto “sniper” made $28 million in profit after buying the latest “Broccoli” memecoins inspired by Binance co-founder Changpenz Zhao’s dog. However, speculation has arisen that the trader may have been an insider wallet.Altcoin season still in early “speculative” phaseSome altcoins have staged a price rally despite a lack of daily active addresses.However, altcoin price appreciation without growing wallet counts indicates that the altcoin season has not arrived, according to Marcin Kazmierczak, co-founder and chief operating officer of Redstone.He told Cointelegraph:“Lower daily active addresses on most altcoins compared to 2021 peaks does suggest we’re earlier in the cycle. Price recovery without matching daily active address growth indicates we’re likely in the initial speculative phase before widespread adoption kicks in.”Meanwhile, the total market capitalization of altcoins, excluding the 10 largest cryptocurrencies, remains near a three-month low of $277 billion, TradingView data shows.This is more than 77% down from their peak market capitalization of $492 billion recorded on Nov. 10, 2021.