$931 Million Bitcoin On The Move: Mt. Gox Sparks Market Jitters

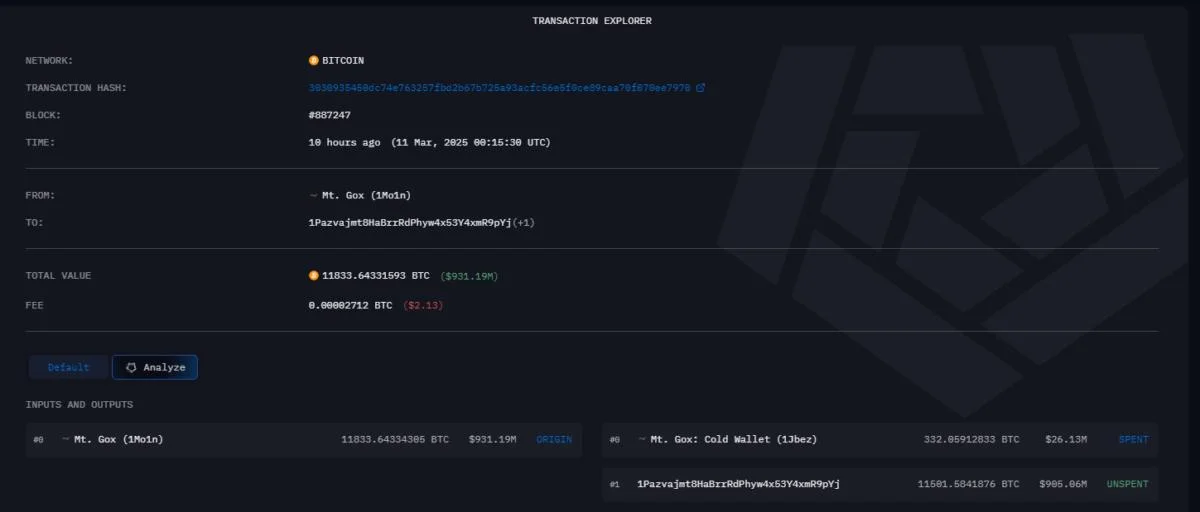

Mt. Gox, the Bitcoin exchange that is now insolvent, has transferred 11,833.6 BTC, totaling approximately $931 million, to new addresses, in a significant development within the cryptocurrency community. The prospective impact of this action on the broader crypto market has sparked discussions.Bitcoin Movement: Details Of The TransferAccording to blockchain research by Arkham Intelligence published on March 11, Mt. Gox made two notable Bitcoin transactions. The first transaction consisted of the 11, 501.58 BTC (about $905 million) being sent to an unknown wallet. The second transaction consisted of the transfer of 332 BTC (about $26.1 million) to a hot wallet.Context And BackgroundThis recent activity is the result of a succession of significant transactions by Mt. Gox. On March 6, the exchange transmitted more than $1 billion in Bitcoin to a wallet assigned the name “1Mo1n.”The most recent transfers were initiated by the same wallet, which is now acknowledged as an official Mt. Gox address. The current value of Mt. Gox’s holdings is approximately $2.85 billion, with an estimated 35,915 BTC. Market Consequences Historically, investors have expressed apprehension regarding the potential for sell-offs of substantial Bitcoin quantities from Mt. Gox, which could potentially lower the price of the flagship crypto.Nevertheless, the market’s immediate response to these recent transfers has been lackluster, indicating that the market may have already factored in these events or that the actual sale of these assets has not yet taken place. A Look Back At Mt. Gox’s History At one point, Mt. Gox handled up to 80% of all Bitcoin transactions worldwide, making it the biggest Bitcoin exchange in the world. The platform experienced a significant security breach between 2011 and 2014, which led to the loss of about 850,000 Bitcoin, which was worth about $500 million at the time.The exchange filed for bankruptcy as a result of this incident, leaving thousands of creditors in a precarious financial – and even psychological – situation.There have been attempts to pay back creditors in recent years. This restitution process includes the recovered funds, including the Bitcoins that are moving right now. The cryptocurrency community keeps a careful eye on the timing and format of these reimbursements since they have the ability to affect market dynamics.The Bigger Picture The bitcoin industry has had several well-publicized security lapses over the years. For instance, the February 2025 hack on the Bybit exchange resulted in the theft of $1.5 billion worth of Ether tokens, making it one of the largest cryptocurrency thefts to date.The most recent $931 million Bitcoin transfer from Mt. Gox has spurred fresh discussions about the security and feasibility of cryptocurrency exchanges. Despite the scenario’s apparent lack of immediate market impact, it serves as a warning of the dangers and complexity inherent in the digital asset space.Featured image from Gemini Imagen, chart from TradingView