80% of Bitcoin short-term holders back in profit as analyst says 'FOMO in full swing'

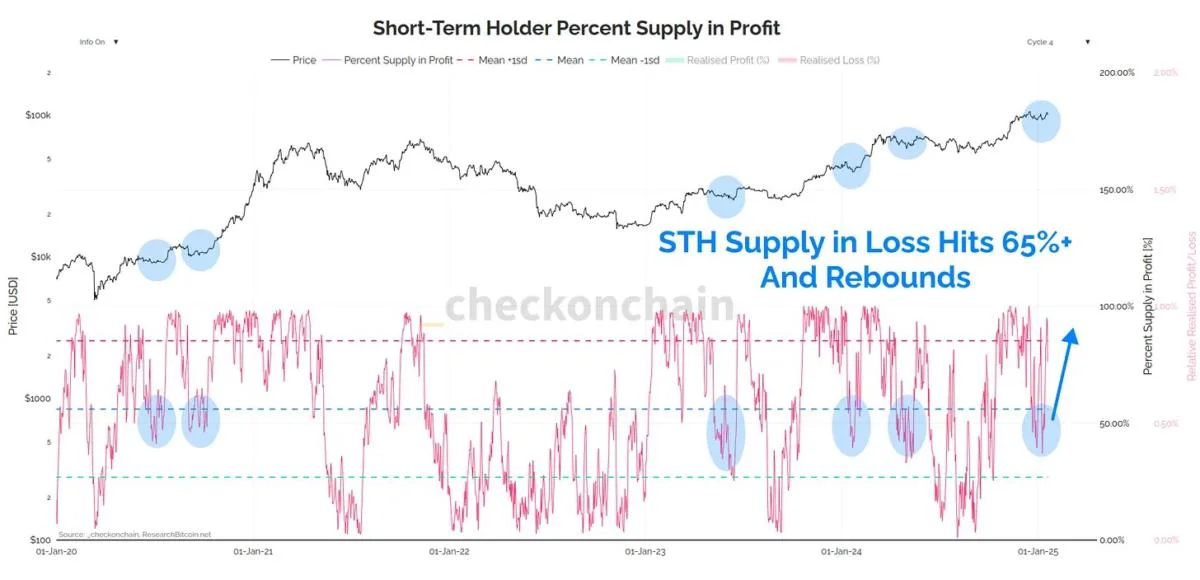

After a 10% price swing on Jan. 20, Bitcoin price remains above $100,000 for the sixth consecutive day, with a value of $106,100 at the time of publishing.Data from Checkonchain, a Bitcoin onchain analysis program, indicated that 80% of short-term holders (STH) were back in the profit bracket after BTC’s recovery above $100,000. Earlier this month, the STH supply in loss dropped to 65% before Bitcoin rebounded. Bitcoin short-term holders returning in profit is a good sign as they become less prone to panic selling during periods of profitability. However, Darkfost, a verified analyst of CryptoQuant, said that short-term holders’ spent output profit ratio (STH-SOPR) is turning negative, which hints that STHs are beginning to sell their BTC at a loss. As illustrated in the chart, STH holders have had prolonged periods of loss in 2024. It is important to note that STH supply in loss can be high, but the unrealized value is still intact if holders don’t sell. The above data suggested that despite STH profitability becoming high over the past week, a little bit of panic selling is creeping in among holders. Despite the concerns, Darkfost added a bullish caveat to the analysis and said, “When this metric turns negative, it often highlights attractive entry points for the long term.”In fact, Axel Adler Jr, a Bitcoin researcher, identified that the increase in volatility is causing “heightened coin movement” on both the buyer’s and seller's side. As observed, the Volatility Composite Index, a metric that measures change in BTC price against market activity, reached its highest level in a month. With Bitcoin exhibiting a new all-time high in the past 24 hours, Adler implied the narrative that “FOMO is in full swing.” Related: Analysts say Trump presidency marks ‘a turning point’ in US crypto policyBitcoin range between $90K to $95K is a “critical zone”With the wider crypto market expecting choppy price action for the next few days, Glassnode, an onchain analytics platform, outlined $95,000 to $90,000 as a” critical zone” for BTC. As illustrated in the chart, this particular range has witnessed significant realized losses since November 2024, where sellers have strongly capitulated, and buyers have jumped in. This implied that the BTC’s bullish structure was solid as long as the BTC price remained above this range. Moreover, Mihir, a crypto educator, pointed out that despite potential price volatility going forward, major technical support allows traders to estimate potential downside risk. The technical analyst underlined $90,000-$80,000 as a “safe retracement” level. Data from CryptoQuant also indicated that the STH realized price is currently around $87,700, which would be BTC’s technical support based on the average BTC price of each token transacted onchain. Related: Bitcoin traders refuse to YOLO after BTC nearly hits $110K — Why are they waiting?This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.