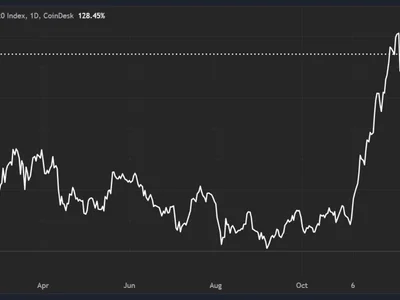

Lido Spikes 20% Following Kraken’s Staking Relaunch In Select US States – Details

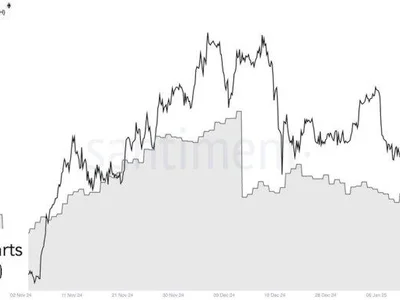

Lido (LDO), a decentralized autonomous organization (DAO) that provides liquid staking solutions for Ethereum (ETH) and other proof-of-stake (PoS) blockchains, saw its token surge 20% in the past 24 hours. The token’s price jumped from $1.98 on Janua